Question: The changes to the Material Outsourcing regime The Prudential Authority ( PA ) and the Financial Sector Conduct Authority ( FSCA ) have issued Joint

The changes to the Material Outsourcing regime

The Prudential Authority PA and the Financial Sector Conduct Authority FSCA have issued Joint Standard of the joint standard" under the Financial Sector Regulation Act, which will take effect on December

This joint standard introduces significant changes to how insurers evaluate their relationships, with certain partners performing specific functions or services on their behalf. These relationships will now be classified as material, requiring insurers to go beyond existing due diligence and controls by assessing the materiality of these partnerships.

You are employed as the compliance officer for a wellknown insurance company, named Peter's Clean Insurance Company PCIC You have been tasked with assessing the regulatory requirements in line with the current requirements of the business, where they are already complying with the soon to be replaced Prudential Standard GOI namely:

PCIC management indicated that they have a ThirdParty Risk Management policy, but it covers some of the requirements in the joint standard.

& PCIC also has a basic due diligence when they consider new service providers, but it is not only for outsourced vendors.

PCIC have been informing the FSCA, but this is generally raised during the annual engagements with the FSCA and not something that has been forthcoming from PCIC to the FSCA.

PCIC have not submitted any formsnotices to the FSCA or PA when a new thirdparty provider relationship commences or is terminated. Sometimes PCIC will inform the FCSA during the annual engagements but only if the FSCA raises a query on the discussion. point.

The Head and Sales: Gauteng region of PCIC mentioned that they are about to onboard a major player in the industry, but the business hasn't assessed the appetite, so he doesn't know if he should go ahead.

In preparation for your upcoming task, you reviewed an article published by Bowmans on the anticipated changes in the joint standard. This article highlighted that both the Prudential Authority PA and the Financial Sector Conduct Authority FSCA apply their respective prudential and market conduct supervisory functions uniformly when assessing compliance.

You have also been provided with PCIC's risk rating scale and instructed to complete the following tasks:

The article you reviewed, written by Rodrigues, C et al and published on June is titled 'South Africa: New Requirements for Outsourcing by Insurers Published in Joint Standard of It outlines key new requirements for insurers, including:

Before entering into an outsourcing arrangement, insurers must conduct appropriate due diligence on each outsourced activity or function to identify and manage all risks involved. This due diligence must evaluate the costs, benefits, and potential risks to the insurer's business. Outsourcing should only proceed when the benefits clearly outweigh the costs and risks.

Insurers must also assess whether a service provider has multiple outsourcing arrangements with other insurers and if these multiple relationships could increase the risks outlined in the Joint Standard. Insurers are prohibited from entering or maintaining outsourcing arrangements with service providers whose key persons do not meet the fit and proper requirements for competence and integrity, as specified in Prudential Standard GOI which governs the fitness and propriety of key persons within the insurance sector.

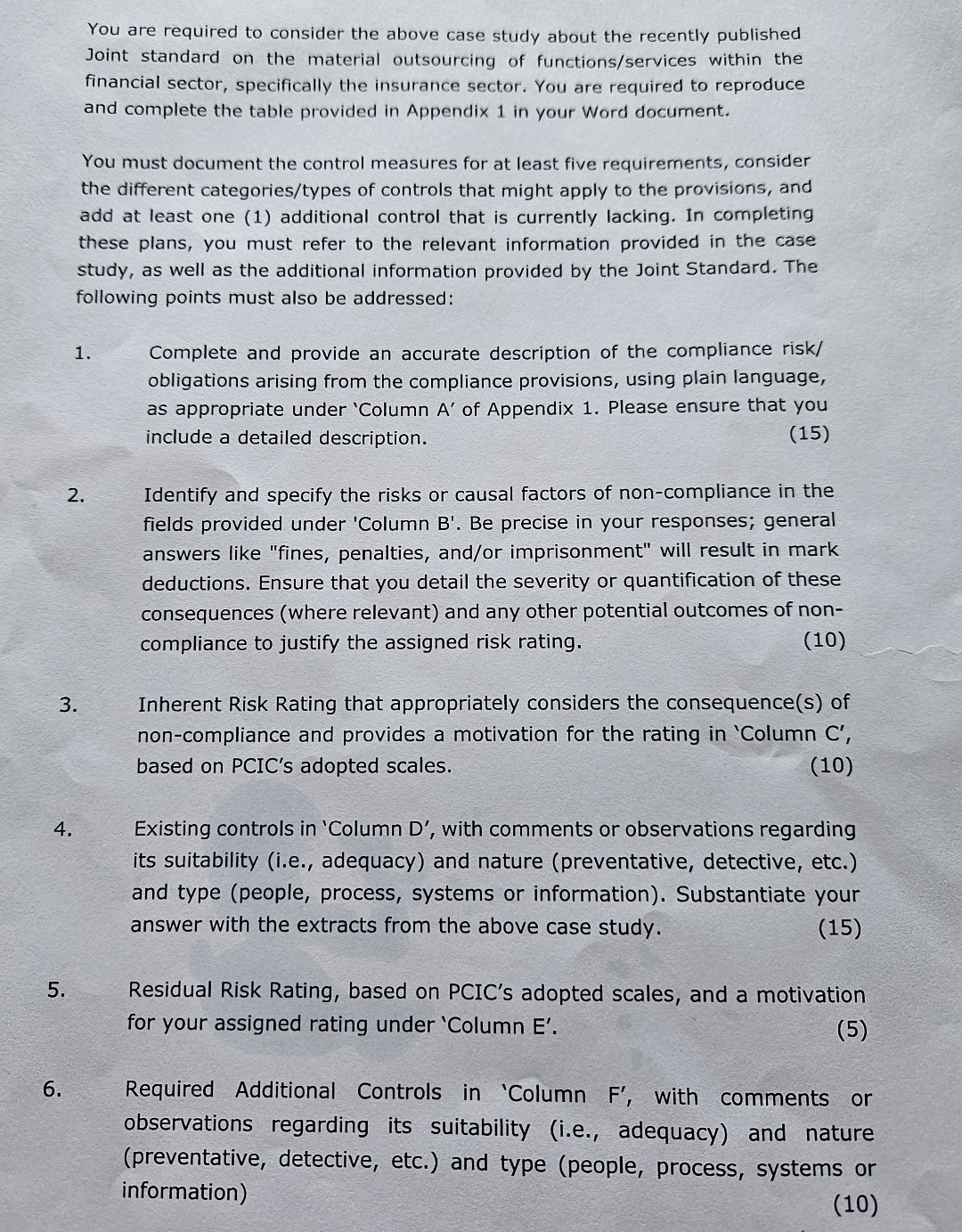

You are required to consider the above case study about the recently published Joint standard on the material outsourcing of functionsservices within the financial sector, specifically the insurance sector. You are required to reproduce and complete the table provided in Appendix in your Word document.

You must document the control measures for at least five requirements, consider the different categoriestypes of controls that might apply to the provisions, and add at least one additional control that is currently lacking. In completing these plans, you must refer to the relevant information provided in the case study, as well as the additional information provided by the Joint Standard. The following points must also be addressed:

Complete and provide an accurate description of the compliance risk obligations arising from the compliance provisions, using plain language, as appropriate under 'Column A of Appendix Please ensure that you include a detailed description.

Identify and specify the risks or causal factors of noncompliance in the fields provided under 'Column B Be precise in your responses; general answers like "fines, penalties, andor imprisonment" will result in mark deductions. Ensure that you detail the severity or quantification of these consequences where relevant and any other potential outcomes of noncompliance to justify the assigned risk rating.

Inherent Risk Rating that appropriately considers the con

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock