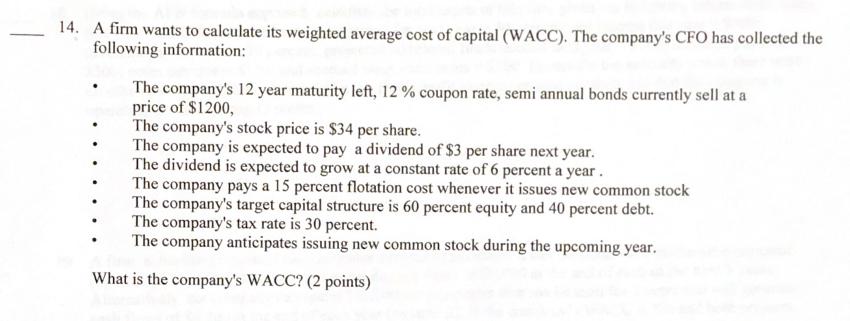

Question: - 14. A firm wants to calculate its weighted average cost of capital (WACC). The company's CFO has collected the following information: The company's

- 14. A firm wants to calculate its weighted average cost of capital (WACC). The company's CFO has collected the following information: The company's 12 year maturity left, 12 % coupon rate, semi annual bonds currently sell at a price of $1200, The company's stock price is $34 per share. The company is expected to pay a dividend of $3 per share next year. The dividend is expected to grow at a constant rate of 6 percent a year. The company pays a 15 percent flotation cost whenever it issues new common stock The company's target capital structure is 60 percent equity and 40 percent debt. The company's tax rate is 30 percent. The company anticipates issuing new common stock during the upcoming year. What is the company's WACC? (2 points)

Step by Step Solution

3.40 Rating (156 Votes )

There are 3 Steps involved in it

Before tox Cost of debt or rtm Semiannual Coupon Redemption Value Price years to maturit... View full answer

Get step-by-step solutions from verified subject matter experts