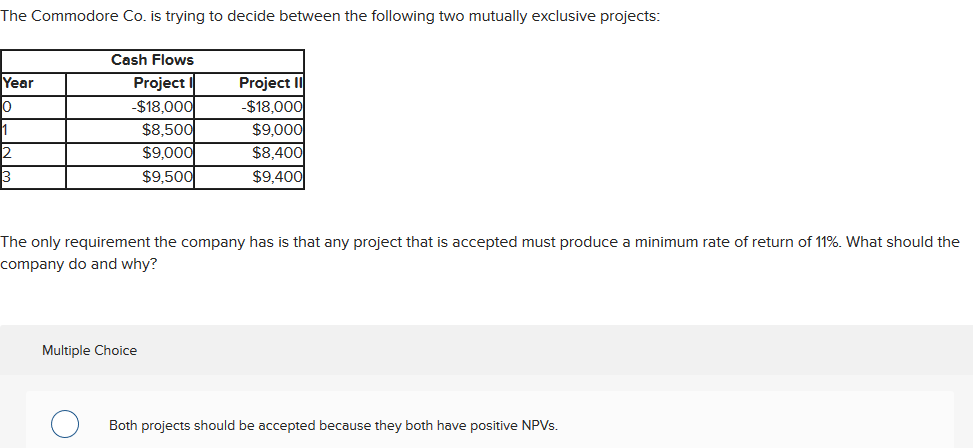

Question: The Commodore Co. is trying to decide between the following two mutually exclusive projects: Year 0 Cash Flows Project $18,000 $8.500 $9,000 $9,500 Project 10

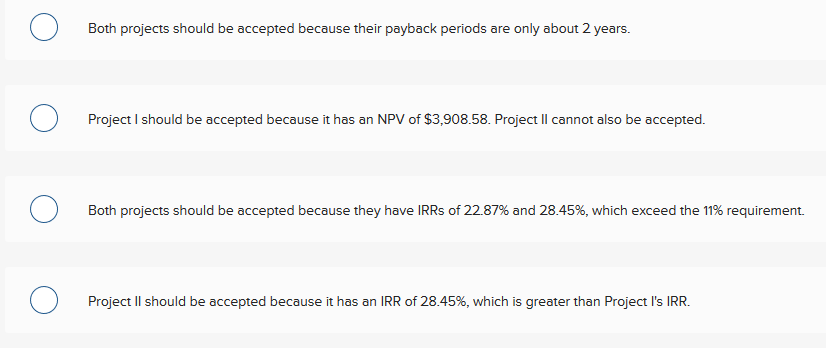

The Commodore Co. is trying to decide between the following two mutually exclusive projects: Year 0 Cash Flows Project $18,000 $8.500 $9,000 $9,500 Project 10 -$18,000 $9,000 $8,400 $9,400 2 The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why? Multiple Choice Both projects should be accepted because they both have positive NPVS. Both projects should be accepted because their payback periods are only about 2 years. Project I should be accepted because it has an NPV of $3,908.58. Project I cannot also be accepted. Both projects should be accepted because they have IRRs of 22.87% and 28.45%, which exceed the 11% requirement. Project I should be accepted because it has an IRR of 28.45%, which is greater than Project l's IRR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts