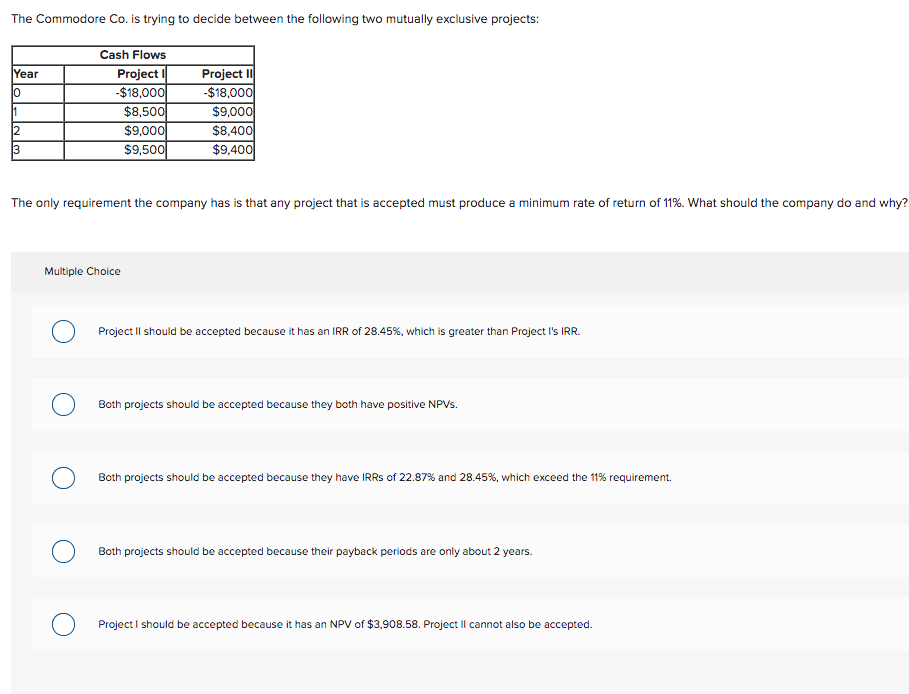

Question: The Commodore Co. is trying to decide between the following two mutually exclusive projects: Year 0 Cash Flows Project $18,000 $8,500 $9,000 $9,500 1 Project

The Commodore Co. is trying to decide between the following two mutually exclusive projects: Year 0 Cash Flows Project $18,000 $8,500 $9,000 $9,500 1 Project 11 -$18,000 $9,000 $8,400 $9.400 12 The only requirement the company has is that any project that is accepted must produce a minimum rate of return of 11%. What should the company do and why? Multiple Choice Project I should be accepted because it has an IRR of 28.45%, which is greater than Project I's IRR. Both projects should be accepted because they both have positive NPVS. Both projects should be accepted because they have IRRs of 22.87% and 28.45%, which exceed the 11% requirement. Both projects should be accepted because their payback periods are only about 2 years. Project I should be accepted because it has an NPV of $3,908.58. Project II cannot also be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts