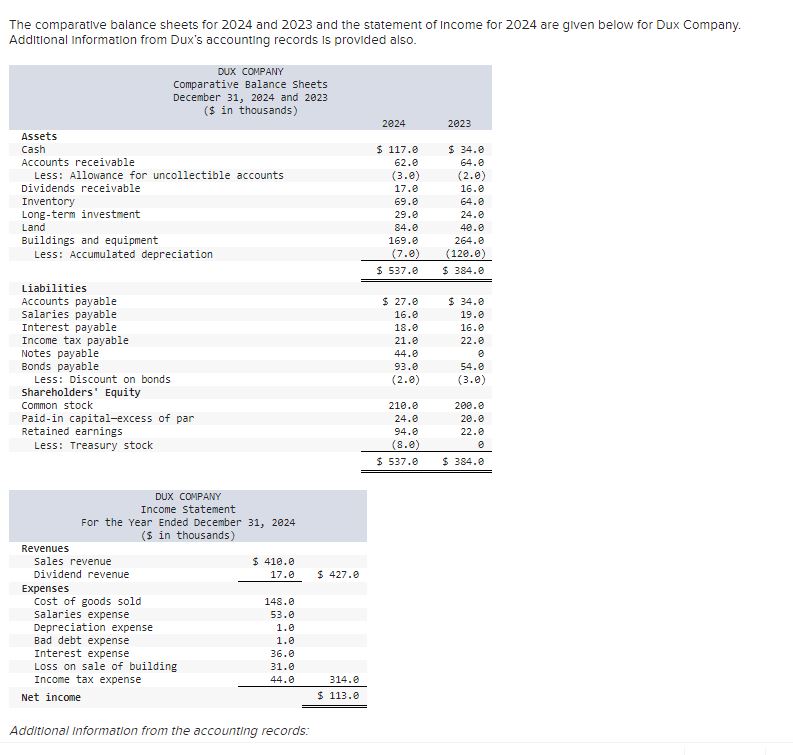

Question: The comparative balance sheets for 2 0 2 4 and 2 0 2 3 and the statement of income for 2 0 2 4 are

The comparative balance sheets for and and the statement of income for are given below for Dux Company. Additional information from the accounting records:

A building that originally cost $ and which was threefourths depreciated, was sold for $

The common stock of Byrd Corporation was purchased for $ as a longterm investment.

Property was acquired by issuing a sevenyear, $ note payable to the seller.

New equipment was purchased for $ cash.

On January bonds were sold at their $ face value.

On January Dux issued a stock dividend shares The market price of the $ par value common stock was $ per share at that time.

Cash dividends of $ were paid to shareholders.

On November shares of common stock were repurchased as treasury stock at a cost of $

Required:

Prepare the statement of cash flows for Dux Company using the indirect method.

Note: Amounts to be deducted should be indicated with a minus sign. Enter your answers in thousands ie should be entered as

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock