Question: The controller of Red Lake Corp requested help in determining income, basic earnings per share, and diluted earnings per share for presentation in the ocmpany's

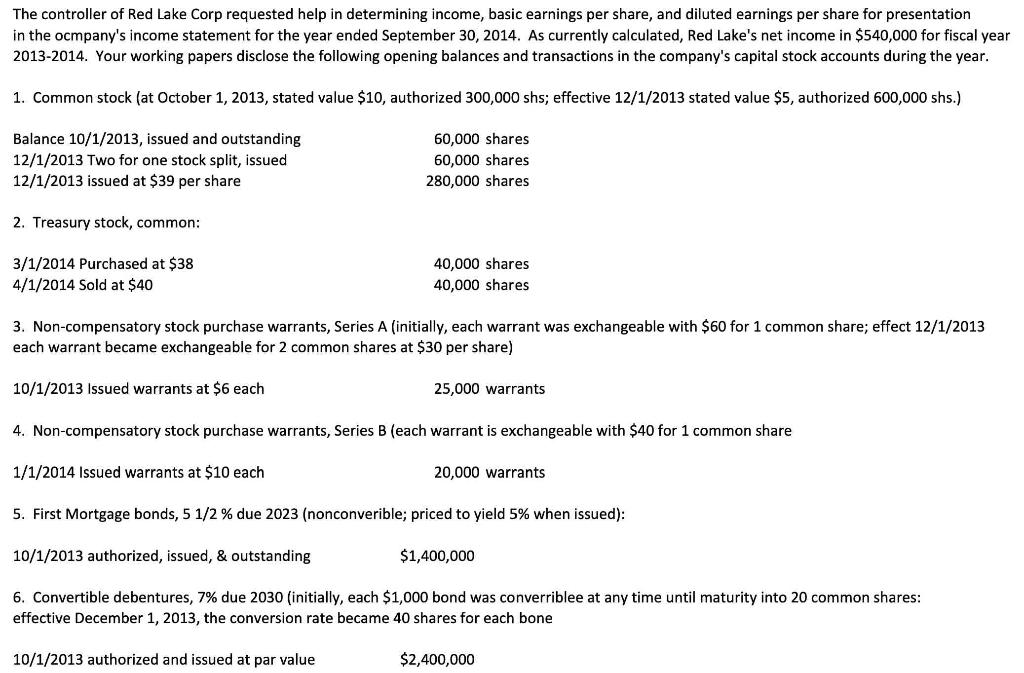

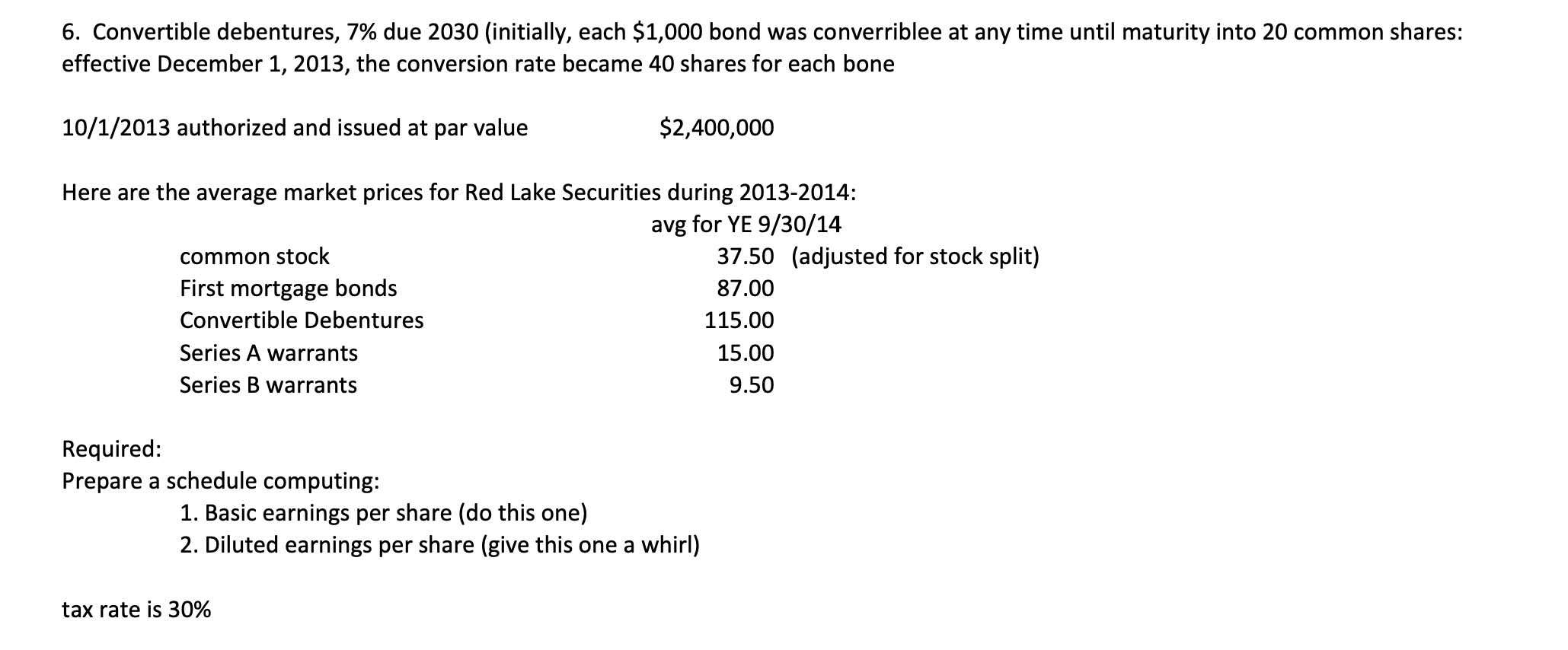

The controller of Red Lake Corp requested help in determining income, basic earnings per share, and diluted earnings per share for presentation in the ocmpany's income statement for the year ended September 30, 2014. As currently calculated, Red Lake's net income in $540,000 for fiscal year 2013-2014. Your working papers disclose the following opening balances and transactions in the company's capital stock accounts during the year. 1. Common stock (at October 1,2013 , stated value $10, authorized 300,000 shs; effective 12/1/2013 stated value $5, authorized 600,000 shs.) 3. Non-compensatory stock purchase warrants, Series A (initially, each warrant was exchangeable with $60 for 1 common share; effect 12/1/2013 each warrant became exchangeable for 2 common shares at $30 per share) 10/1/2013 Issued warrants at $6 each 25,000 warrants 4. Non-compensatory stock purchase warrants, Series B (each warrant is exchangeable with $40 for 1 common share 1/1/2014 Issued warrants at $10 each 20,000 warrants 5. First Mortgage bonds, 51/2% due 2023 (nonconverible; priced to yield 5% when issued): 10/1/2013 authorized, issued, \& outstanding $1,400,000 6. Convertible debentures, 7% due 2030 (initially, each $1,000 bond was converriblee at any time until maturity into 20 common shares: effective December 1,2013 , the conversion rate became 40 shares for each bone 10/1/2013 authorized and issued at par value $2,400,000 6. Convertible debentures, 7% due 2030 (initially, each $1,000 bond was converriblee at any time until maturity into 20 common shares: effective December 1,2013 , the conversion rate became 40 shares for each bone 10/1/2013 authorized and issued ta par value $2,400,000 Here are the average market prices for Red Lake Securities during 2013-2014: Required: Prepare a schedule computing: 1. Basic earnings per share (do this one) 2. Diluted earnings per share (give this one a whirl)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts