Question: The correct answer according to the answer sheet is 858.51. Please explain! You work for a global marketing firm who considers aquiring a company named

The correct answer according to the answer sheet is 858.51. Please explain!

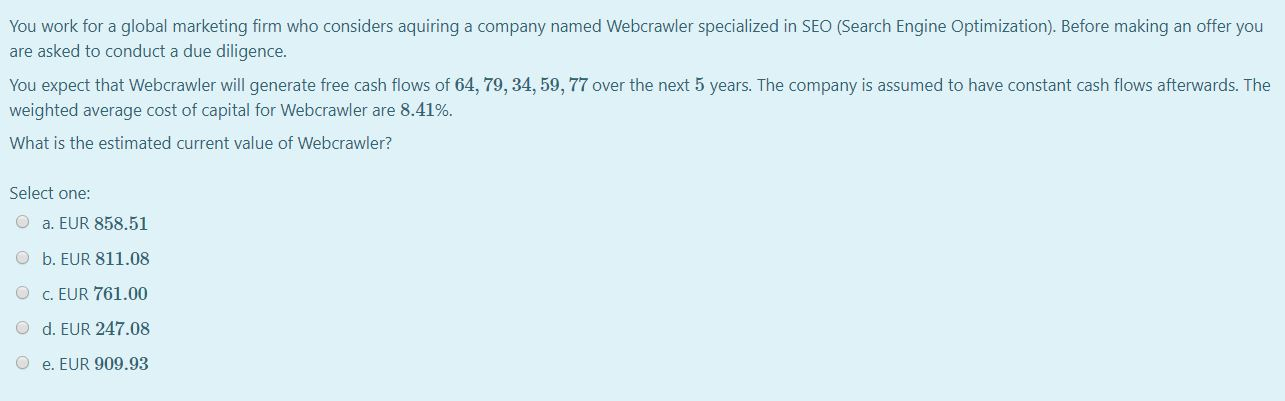

You work for a global marketing firm who considers aquiring a company named Webcrawler specialized in SEO (Search Engine Optimization). Before making an offer you are asked to conduct a due diligence. You expect that Webcrawler will generate free cash flows of 64, 79, 34, 59,77 over the next 5 years. The company is assumed to have constant cash flows afterwards. The weighted average cost of capital for Webcrawler are 8.41%. What is the estimated current value of Webcrawler? Select one: a. EUR 858.51 O b. EUR 811.08 O C. EUR 761.00 O d. EUR 247.08 e. EUR 909.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts