Question: The correct answer is bolded. I need to know how to solve the problem step-by-step. 5. You own a portfolio that has 2,533 shares of

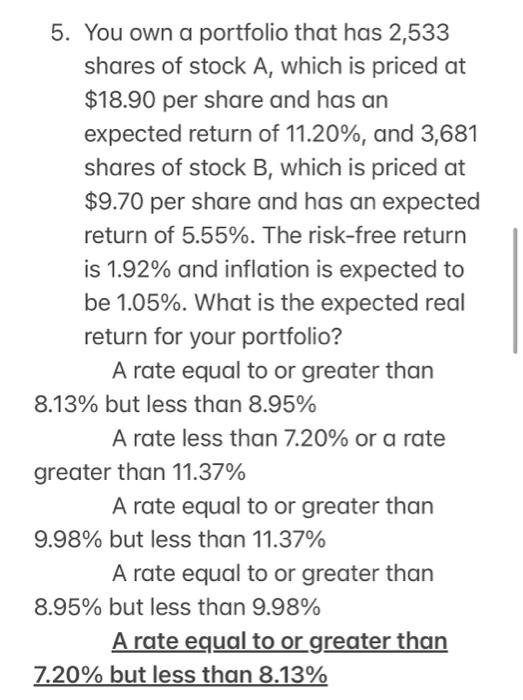

5. You own a portfolio that has 2,533 shares of stock A, which is priced at $18.90 per share and has an expected return of 11.20%, and 3,681 shares of stock B, which is priced at $9.70 per share and has an expected return of 5.55%. The risk-free return is 1.92% and inflation is expected to be 1.05%. What is the expected real return for your portfolio? A rate equal to or greater than 8.13% but less than 8.95% A rate less than 7.20% or a rate greater than 11.37% A rate equal to or greater than 9.98% but less than 11.37% A rate equal to or greater than 8.95% but less than 9.98% A rate equal to or greater than 7.20% but less than 8.13%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts