Question: The correct answer is bolded. I need to know how to solve the problem step-by-step with an explanation for the answer. 8. Portfolio A is

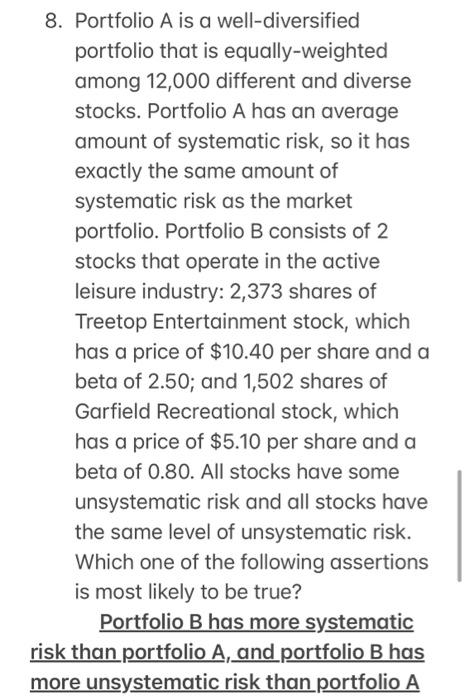

8. Portfolio A is a well-diversified portfolio that is equally-weighted among 12,000 different and diverse stocks. Portfolio A has an average amount of systematic risk, so it has exactly the same amount of systematic risk as the market portfolio. Portfolio B consists of 2 stocks that operate in the active leisure industry: 2,373 shares of Treetop Entertainment stock, which has a price of $10.40 per share and a beta of 2.50; and 1,502 shares of Garfield Recreational stock, which has a price of $5.10 per share and a beta of 0.80. All stocks have some unsystematic risk and all stocks have the same level of unsystematic risk. Which one of the following assertions is most likely to be true? Portfolio B has more systematic risk than portfolio A, and portfolio B has more unsystematic risk than portfolio A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts