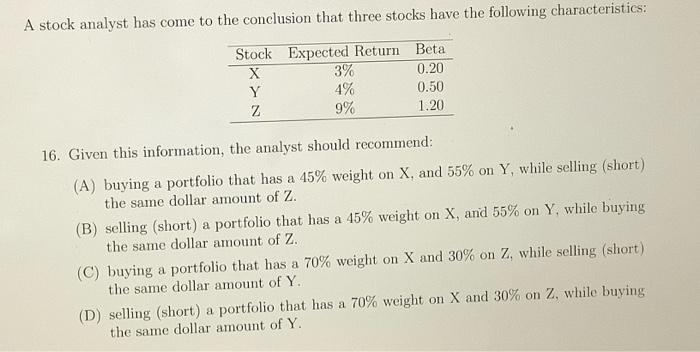

Question: the correct answer is C, but I am not sure how they found the weights is beta used at all? A stock analyst has come

A stock analyst has come to the conclusion that three stocks have the following characteristics: Stock Expected Return Beta X 0.20 Y 0.50 Z 1.20 3% 4% 9% 16. Given this information, the analyst should recommend: (A) buying a portfolio that has a 45% weight on X, and 55% on Y, while selling (short) the same dollar amount of Z. (B) selling (short) a portfolio that has a 45% weight on X, and 55% on Y, while buying the same dollar amount of Z. (C) buying a portfolio that has a 70% weight on X and 30% on Z, while selling (short) the same dollar amount of Y. (D) selling (short) a portfolio that has a 70% weight on X and 30% on Z, while buying the same dollar amount of Y

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts