Question: the correct answer is D. if you could help me figure out why that would be great! Stock X has an expected return of 20

the correct answer is D. if you could help me figure out why that would be great!

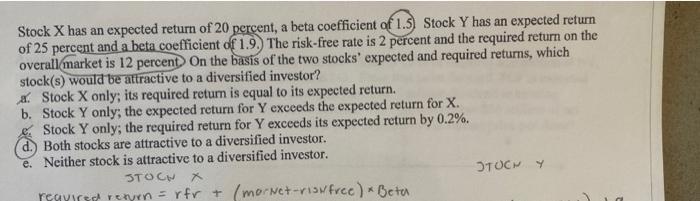

the correct answer is D. if you could help me figure out why that would be great! Stock X has an expected return of 20 percent, a beta coefficient of 1.5) Stock Y has an expected return of 25 percent and a beta coefficient of 1.9. The risk-free rate is 2 percent and the required return on the overall market is 12 percent on the basis of the two stocks' expected and required returns, which stock(s) would be attractive to a diversified investor? X. Stock X only; its required return is equal to its expected return. b. Stock Y only, the expected return for Y exceeds the expected return for X. . Stock Y only; the required return for Y exceeds its expected return by 0.2%. d. Both stocks are attractive to a diversified investor. e. Neither stock is attractive to a diversified investor. STOC x STOCH Y Trays return = rfr + mornet-vis free) *Beter

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts