Question: the correct answer is P 0 = $2,000/(1 + .051/2) 42 P 0 = $694.60 The market value of the debt is: MV D =

P0 = $2,000/(1 + .051/2)42

P0 = $2,000/(1 + .051/2)42 P0 = $694.60

The market value of the debt is:

MVD = 125,000($694.60)

MVD = $86,824,460.03

So, the total value of the firm is:

V = $86,824,460.03 + 77,800,000

V = $164,624,460.03

This means the weight of debt in the capital structure is:

D/V = $86,824,460.03/$164,624,460.03

D/V = .5274

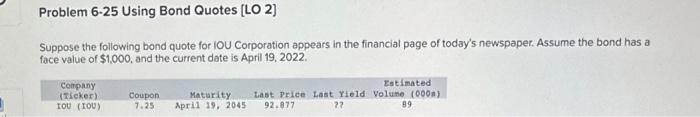

Problem 6-25 Using Bond Quotes [LO 2) Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 19, 2022 . Problem 6-25 Using Bond Quotes [LO 2) Suppose the following bond quote for IOU Corporation appears in the financial page of today's newspaper. Assume the bond has a face value of $1,000, and the current date is April 19, 2022

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts