Question: The correlation coefficient between stocks and bonds has been estimated to be -1.0, while the risk-free rate is equal to 4%. a.) What combination of

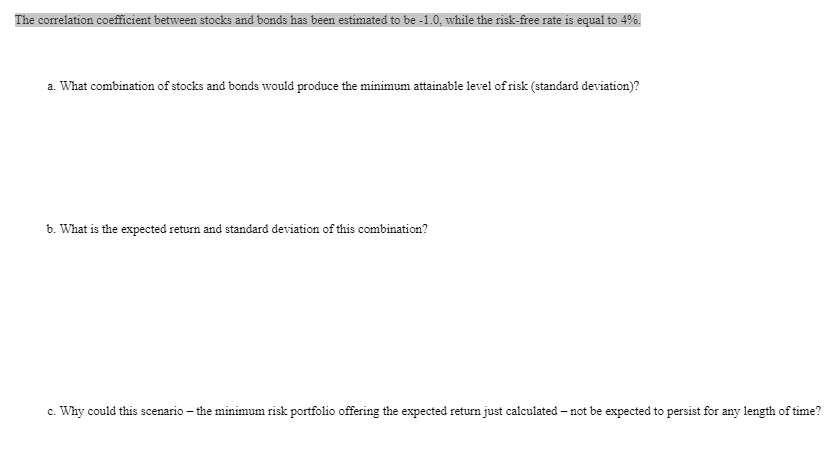

The correlation coefficient between stocks and bonds has been estimated to be -1.0, while the risk-free rate is equal to 4%.

a.) What combination of stocks and bonds would produce the minimum attainable level of risk (standard deviation)?

b.) What is the expected return and standard deviation of this combination?

c.) Why could this scenario the minimum risk portfolio offering the expected return just calculated not be expected to persist for any length of time?

The correlation coefficient between stocks and bonds has been estimated to be -1.0, while the risk-free rate is equal to 4%. a. What combination of stocks and bonds would produce the minimum attainable level of risk (standard deviation)? b. What is the expected return and standard deviation of this combination? c. Why could this scenario - the minimum risk portfolio offering the expected return just calculated - not be expected to persist for any length of time? The correlation coefficient between stocks and bonds has been estimated to be -1.0, while the risk-free rate is equal to 4%. a. What combination of stocks and bonds would produce the minimum attainable level of risk (standard deviation)? b. What is the expected return and standard deviation of this combination? c. Why could this scenario - the minimum risk portfolio offering the expected return just calculated - not be expected to persist for any length of time

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts