Question: The current exchange rate is W (Korean Won)950 per $1. Ewha corp. is a Korean exporting company and is scheduled to receive US dollars

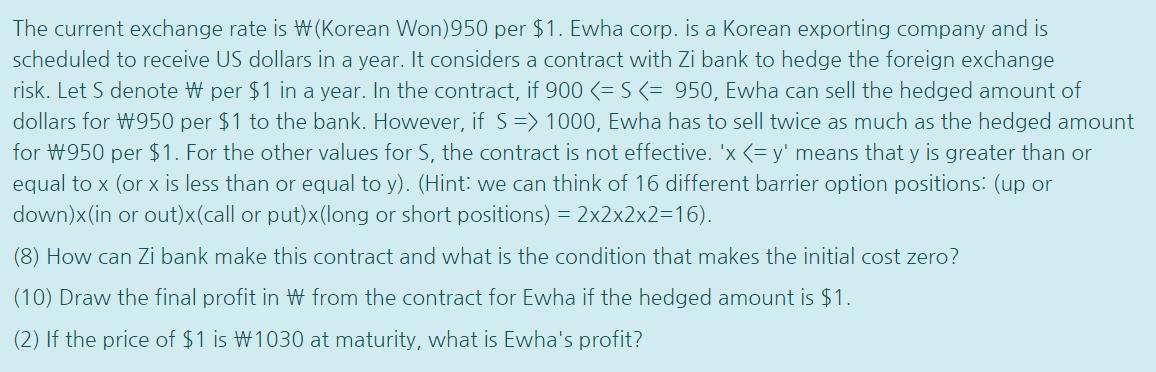

The current exchange rate is W (Korean Won)950 per $1. Ewha corp. is a Korean exporting company and is scheduled to receive US dollars in a year. It considers a contract with Zi bank to hedge the foreign exchange risk. Let S denote W per $1 in a year. In the contract, if 900 (= S (= 950, Ewha can sell the hedged amount of dollars for W950 per $1 to the bank. However, if S=> 1000, Ewha has to sell twice as much as the hedged amount for W950 per $1. For the other values for S, the contract is not effective. 'x

Step by Step Solution

★★★★★

3.42 Rating (158 Votes )

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock