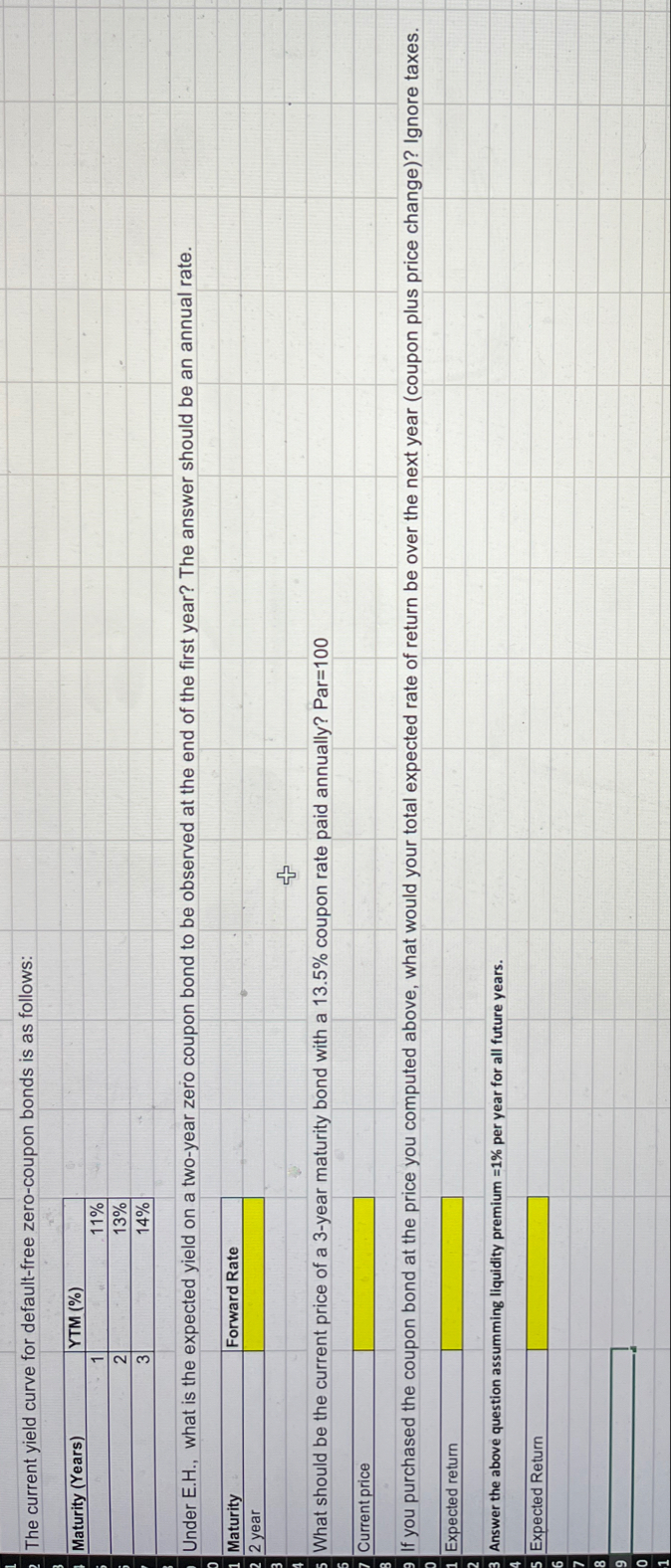

Question: The current yield curve for default - free zero - coupon bonds is as follows: table [ [ Maturity ( Years ) , YTM

The current yield curve for defaultfree zerocoupon bonds is as follows:

tableMaturity YearsYTM

Under EH what is the expected yield on a twoyear zero coupon bond to be observed at the end of the first year? The answer should be an annual rate.

tableMaturityForward Rate year,

What should be the current price of a year maturity bond with a coupon rate paid annually? Par

tableCurrent price,

If you purchased the coupon bond at the price you computed above, what would your total expected rate of return be over the next year coupon plus price change Ignore taxes.

Expected return

Answer the above question assumming liquidity premium per year for all future years.

Expected Return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock