Question: The data needed for the adjustments on December 31 are as follows: a.-b. Ending merchandise inventory, $68,850. c. Uncollectible accounts, 0.5 percent of net credit

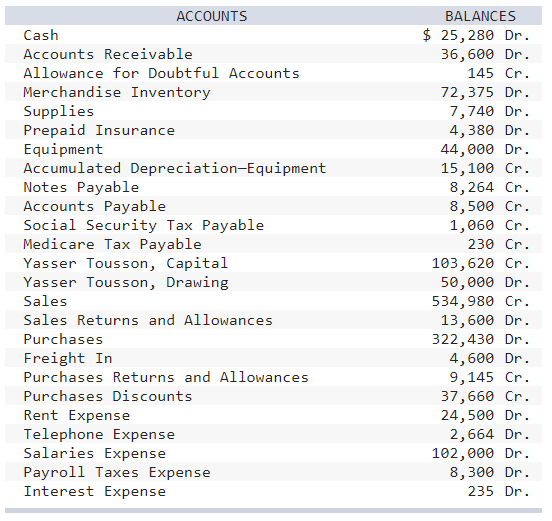

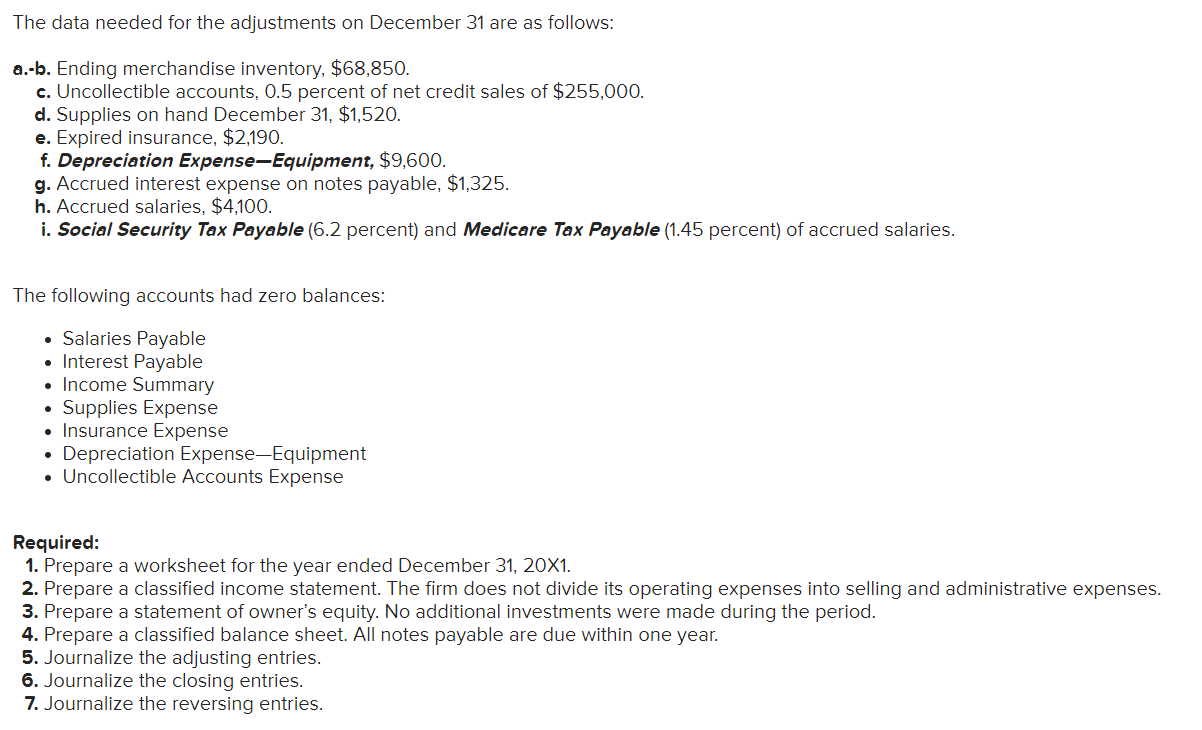

The data needed for the adjustments on December 31 are as follows: a.-b. Ending merchandise inventory, $68,850. c. Uncollectible accounts, 0.5 percent of net credit sales of $255,000. d. Supplies on hand December 31, $1,520. e. Expired insurance, $2,190. f. Depreciation Expense-Equipment, $9,600. g. Accrued interest expense on notes payable, $1,325. h. Accrued salaries, $4,100. i. Social Security Tax Payable (6.2 percent) and Medicare Tax Payable (1.45 percent) of accrued salaries. The following accounts had zero balances: - Salaries Payable - Interest Payable - Income Summary - Supplies Expense - Insurance Expense - Depreciation Expense-Equipment - Uncollectible Accounts Expense Required: 1. Prepare a worksheet for the year ended December 31,201. 2. Prepare a classified income statement. The firm does not divide its operating expenses into selling and administrative expenses. 3. Prepare a statement of owner's equity. No additional investments were made during the period. 4. Prepare a classified balance sheet. All notes payable are due within one year. 5. Journalize the adjusting entries. 6. Journalize the closing entries. 7. Journalize the reversing entries

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts