Question: The data needed to be used is below: Firm Name Year Month Price Market Value Book Value CHINA PHARMACEUTICAL 2005 12 1.31 2012 2567 CHINA

The data needed to be used is below:

| Firm Name | Year | Month | Price | Market Value | Book Value |

| CHINA PHARMACEUTICAL | 2005 | 12 | 1.31 | 2012 | 2567 |

| CHINA PHARMACEUTICAL | 2006 | 6 | 0.91 | 2074 | 2735 |

| CHINA PHARMACEUTICAL | 2006 | 7 | 0.9 | 1407 | 2735 |

| CHINA PHARMACEUTICAL | 2006 | 8 | 1.09 | 1390 | 2735 |

| CHINA SHINEWAY PHARM.GP. | 2005 | 12 | 3.625 | 2642 | 476 |

| CHINA SHINEWAY PHARM.GP. | 2006 | 6 | 5.8 | 5367 | 1700 |

| CHINA SHINEWAY PHARM.GP. | 2006 | 7 | 5.8 | 4822 | 1700 |

| CHINA SHINEWAY PHARM.GP. | 2006 | 8 | 5.85 | 4816 | 1700 |

| PICC PROPERTY & CLTY.'H' | 2005 | 12 | 2.025 | 6641 | 21490 |

| PICC PROPERTY & CLTY.'H' | 2006 | 6 | 2.65 | 10258 | 21756 |

| PICC PROPERTY & CLTY.'H' | 2006 | 7 | 2.775 | 9208 | 21756 |

| PICC PROPERTY & CLTY.'H' | 2006 | 8 | 2.93 | 9630 | 21756 |

| TSINGTAO BREWERY 'H' | 2005 | 12 | 8 | 5305 | 4146 |

| TSINGTAO BREWERY 'H' | 2006 | 6 | 9.1 | 6162 | 4154 |

| TSINGTAO BREWERY 'H' | 2006 | 7 | 8.85 | 5993 | 4154 |

| TSINGTAO BREWERY 'H' | 2006 | 8 | 8.84 | 5821 | 4154 |

| VITASOY INTL.HDG. | 2005 | 12 | 3 | 2801 | 1598 |

| VITASOY INTL.HDG. | 2006 | 6 | 2.85 | 2777 | 1600 |

| VITASOY INTL.HDG. | 2006 | 7 | 2.825 | 2879 | 1600 |

| VITASOY INTL.HDG. | 2006 | 8 | 3.2 | 2852 | 1600 |

| VTECH HOLDINGS | 2005 | 12 | 25.8 | 7550 | 1625 |

| VTECH HOLDINGS | 2006 | 6 | 34.8 | 9094 | 2033 |

| VTECH HOLDINGS | 2006 | 7 | 40.45 | 8358 | 2033 |

| VTECH HOLDINGS | 2006 | 8 | 38.7 | 9703 | 2033 |

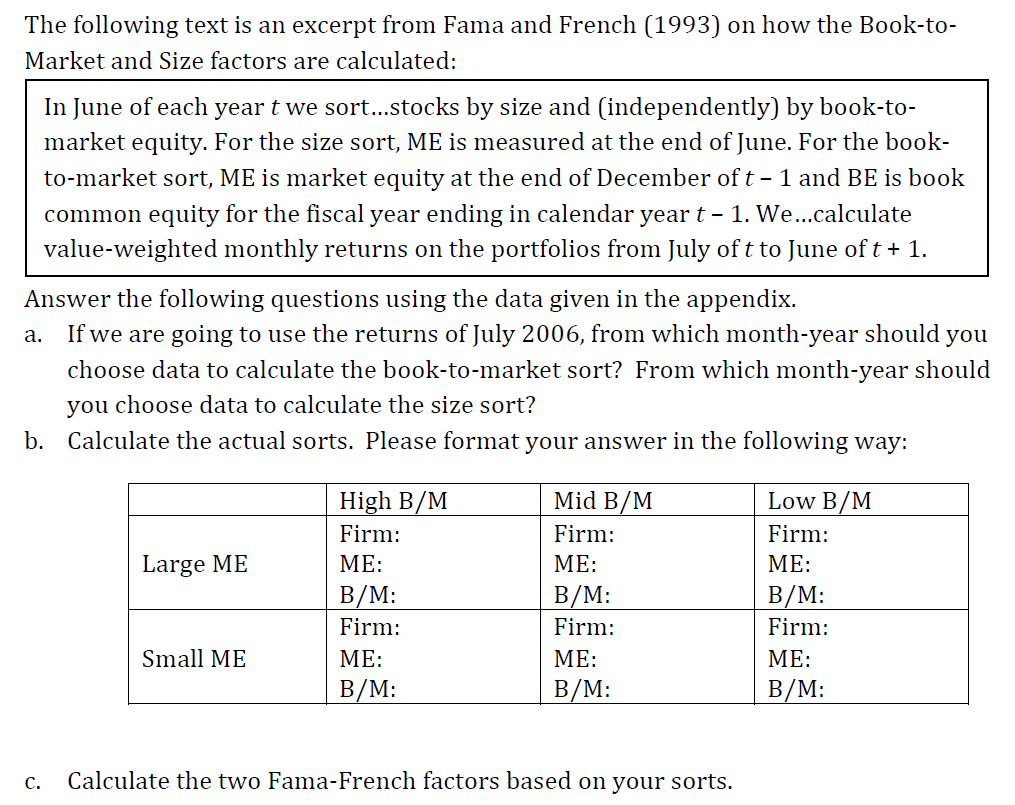

The following text is an excerpt from Fama and French (1993) on how the Book-to- Market and Size factors are calculated: In June of each year t we sort...stocks by size and (independently) by book-to- market equity. For the size sort, ME is measured at the end of June. For the book- to-market sort, ME is market equity at the end of December oft - 1 and BE is book common equity for the fiscal year ending in calendar year t - 1. We...calculate value-weighted monthly returns on the portfolios from July oft to June of t + 1. Answer the following questions using the data given in the appendix. If we are going to use the returns of July 2006, from which month-year should you choose data to calculate the book-to-market sort? From which month-year should you choose data to calculate the size sort? b. Calculate the actual sorts. Please format your answer in the following way: a. Large ME High B/M Firm: ME: B/M: Firm: ME: B/M: Mid B/M Firm: ME: B/M: Firm: ME: B/M: Low B/M Firm: ME: B/M: Firm: ME: B/M: Small ME c. Calculate the two Fama-French factors based on your sorts. The following text is an excerpt from Fama and French (1993) on how the Book-to- Market and Size factors are calculated: In June of each year t we sort...stocks by size and (independently) by book-to- market equity. For the size sort, ME is measured at the end of June. For the book- to-market sort, ME is market equity at the end of December oft - 1 and BE is book common equity for the fiscal year ending in calendar year t - 1. We...calculate value-weighted monthly returns on the portfolios from July oft to June of t + 1. Answer the following questions using the data given in the appendix. If we are going to use the returns of July 2006, from which month-year should you choose data to calculate the book-to-market sort? From which month-year should you choose data to calculate the size sort? b. Calculate the actual sorts. Please format your answer in the following way: a. Large ME High B/M Firm: ME: B/M: Firm: ME: B/M: Mid B/M Firm: ME: B/M: Firm: ME: B/M: Low B/M Firm: ME: B/M: Firm: ME: B/M: Small ME c. Calculate the two Fama-French factors based on your sorts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts