Question: The data table is above. Please let me know if you need anything else. The following option prices were downloaded from the CBOE on 7

The data table is above. Please let me know if you need anything else.

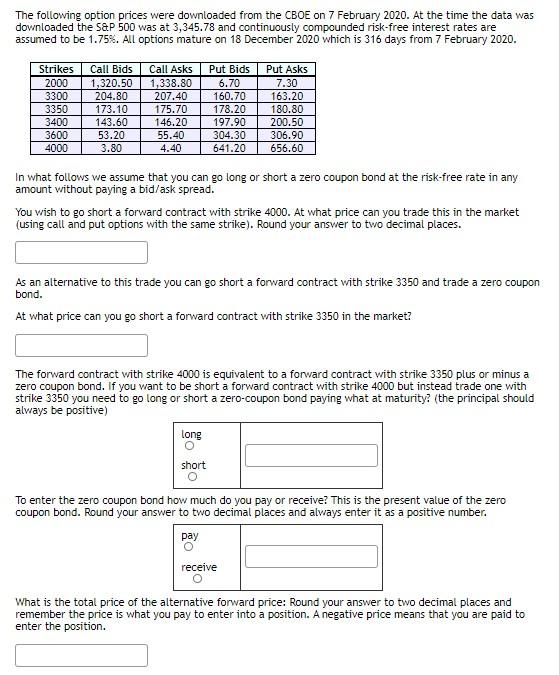

The following option prices were downloaded from the CBOE on 7 February 2020. At the time the data was downloaded the S&P 500 was at 3,345.78 and continuously compounded risk-free interest rates are assumed to be 1.75%. All options mature on 18 December 2020 which is 316 days from 7 February 2020. Strikes 2000 3300 3350 3400 3600 4000 Call Bids 1,320.50 204.80 173.10 143.60 53.20 3.80 Call Asks 1,338.80 207.40 175.70 146.20 55.40 4.40 Put Bids 6.70 160.70 178.20 197.90 304.30 641.20 Put Asks 7.30 163.20 180.80 200.50 306.90 656.60 In what follows we assume that you can go long or short a zero coupon bond at the risk-free rate in any amount without paying a bid/ask spread. You wish to go short a forward contract with strike 4000. At what price can you trade this in the market (using call and put options with the same strike). Round your answer to two decimal places. As an alternative to this trade you can go short a forward contract with strike 3350 and trade a zero coupon bond. At what price can you go short a forward contract with strike 3350 in the market? The forward contract with strike 4000 is equivalent to a forward contract with strike 3350 plus or minus a zero coupon bond. If you want to be short a forward contract with strike 4000 but instead trade one with strike 3350 you need to go long or short a zero-coupon bond paying what at maturity? (the principal should always be positive) long short To enter the zero coupon bond how much do you pay or receive? This is the present value of the zero coupon bond. Round your answer to two decimal places and always enter it as a positive number. pay receive What is the total price of the alternative forward price: Round your answer to two decimal places and remember the price is what you pay to enter into a position. A negative price means that you are paid to enter the position. The following option prices were downloaded from the CBOE on 7 February 2020. At the time the data was downloaded the S&P 500 was at 3,345.78 and continuously compounded risk-free interest rates are assumed to be 1.75%. All options mature on 18 December 2020 which is 316 days from 7 February 2020. Strikes 2000 3300 3350 3400 3600 4000 Call Bids 1,320.50 204.80 173.10 143.60 53.20 3.80 Call Asks 1,338.80 207.40 175.70 146.20 55.40 4.40 Put Bids 6.70 160.70 178.20 197.90 304.30 641.20 Put Asks 7.30 163.20 180.80 200.50 306.90 656.60 In what follows we assume that you can go long or short a zero coupon bond at the risk-free rate in any amount without paying a bid/ask spread. You wish to go short a forward contract with strike 4000. At what price can you trade this in the market (using call and put options with the same strike). Round your answer to two decimal places. As an alternative to this trade you can go short a forward contract with strike 3350 and trade a zero coupon bond. At what price can you go short a forward contract with strike 3350 in the market? The forward contract with strike 4000 is equivalent to a forward contract with strike 3350 plus or minus a zero coupon bond. If you want to be short a forward contract with strike 4000 but instead trade one with strike 3350 you need to go long or short a zero-coupon bond paying what at maturity? (the principal should always be positive) long short To enter the zero coupon bond how much do you pay or receive? This is the present value of the zero coupon bond. Round your answer to two decimal places and always enter it as a positive number. pay receive What is the total price of the alternative forward price: Round your answer to two decimal places and remember the price is what you pay to enter into a position. A negative price means that you are paid to enter the position

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts