Question: The decision to get an advanced degree involves many cash flows that we need to sort out. Consider the simple problem: You are 28 years

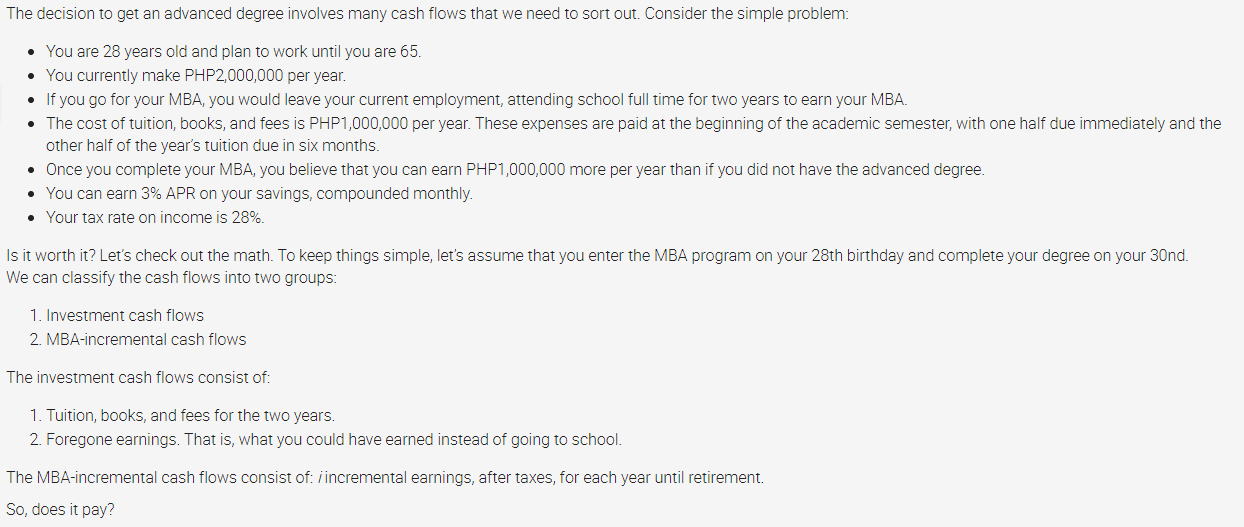

The decision to get an advanced degree involves many cash flows that we need to sort out. Consider the simple problem: You are 28 years old and plan to work until you are 65. You currently make PHP2,000,000 per year. If you go for your MBA, you would leave your current employment, attending school full time for two years to earn your MBA. The cost of tuition, books, and fees is PHP1,000,000 per year. These expenses are paid at the beginning of the academic semester, with one half due immediately and the other half of the year's tuition due in six months. Once you complete your MBA, you believe that you can earn PHP1,000,000 more per year than if you did not have the advanced degree. You can earn 3% APR on your savings, compounded monthly Your tax rate on income is 28%. Is it worth it? Let's check out the math. To keep things simple, let's assume that you enter the MBA program on your 28th birthday and complete your degree on your 30nd. We can classify the cash flows into two groups: 1. Investment cash flows 2. MBA-incremental cash flows The investment cash flows consist of: 1. Tuition, books, and fees for the two years. 2. Foregone earnings. That is, what you could have earned instead of going to school. The MBA-incremental cash flows consist of: incremental earnings, after taxes, for each year until retirement. So, does it pay? The decision to get an advanced degree involves many cash flows that we need to sort out. Consider the simple problem: You are 28 years old and plan to work until you are 65. You currently make PHP2,000,000 per year. If you go for your MBA, you would leave your current employment, attending school full time for two years to earn your MBA. The cost of tuition, books, and fees is PHP1,000,000 per year. These expenses are paid at the beginning of the academic semester, with one half due immediately and the other half of the year's tuition due in six months. Once you complete your MBA, you believe that you can earn PHP1,000,000 more per year than if you did not have the advanced degree. You can earn 3% APR on your savings, compounded monthly Your tax rate on income is 28%. Is it worth it? Let's check out the math. To keep things simple, let's assume that you enter the MBA program on your 28th birthday and complete your degree on your 30nd. We can classify the cash flows into two groups: 1. Investment cash flows 2. MBA-incremental cash flows The investment cash flows consist of: 1. Tuition, books, and fees for the two years. 2. Foregone earnings. That is, what you could have earned instead of going to school. The MBA-incremental cash flows consist of: incremental earnings, after taxes, for each year until retirement. So, does it pay

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts