The Dexter Products Company manufactures a single product. Its operations are a continuing process carried on...

Fantastic news! We've Found the answer you've been seeking!

Question:

Transcribed Image Text:

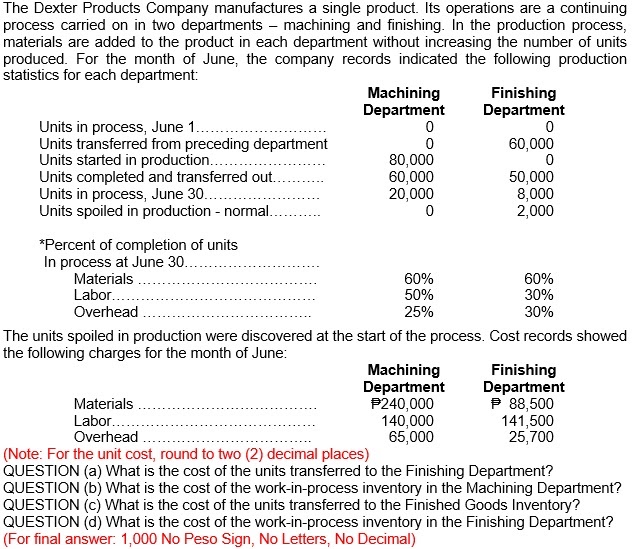

The Dexter Products Company manufactures a single product. Its operations are a continuing process carried on in two departments - machining and finishing. In the production process, materials are added to the product in each department without increasing the number of units produced. For the month of June, the company records indicated the following production statistics for each department: Machining Department Finishing Department Units in process, June 1... 0 0 Units transferred from preceding department 0 60,000 Units started in production... 80,000 0 Units completed and transferred out... 60,000 50,000 Units in process, June 30.... 20,000 8,000 Units spoiled in production - normal.. 0 2,000 *Percent of completion of units In process at June 30.... Materials Labor..... Overhead 60% 60% 50% 30% 25% 30% The units spoiled in production were discovered at the start of the process. Cost records showed the following charges for the month of June: Materials Labor.... Overhead Machining Department $240,000 140,000 Finishing Department P 88,500 141,500 65,000 25,700 (Note: For the unit cost, round to two (2) decimal places) QUESTION (a) What is the cost of the units transferred to the Finishing Department? QUESTION (b) What is the cost of the work-in-process inventory in the Machining Department? QUESTION (c) What is the cost of the units transferred to the Finished Goods Inventory? QUESTION (d) What is the cost of the work-in-process inventory in the Finishing Department? (For final answer: 1,000 No Peso Sign, No Letters, No Decimal) The Dexter Products Company manufactures a single product. Its operations are a continuing process carried on in two departments - machining and finishing. In the production process, materials are added to the product in each department without increasing the number of units produced. For the month of June, the company records indicated the following production statistics for each department: Machining Department Finishing Department Units in process, June 1... 0 0 Units transferred from preceding department 0 60,000 Units started in production... 80,000 0 Units completed and transferred out... 60,000 50,000 Units in process, June 30.... 20,000 8,000 Units spoiled in production - normal.. 0 2,000 *Percent of completion of units In process at June 30.... Materials Labor..... Overhead 60% 60% 50% 30% 25% 30% The units spoiled in production were discovered at the start of the process. Cost records showed the following charges for the month of June: Materials Labor.... Overhead Machining Department $240,000 140,000 Finishing Department P 88,500 141,500 65,000 25,700 (Note: For the unit cost, round to two (2) decimal places) QUESTION (a) What is the cost of the units transferred to the Finishing Department? QUESTION (b) What is the cost of the work-in-process inventory in the Machining Department? QUESTION (c) What is the cost of the units transferred to the Finished Goods Inventory? QUESTION (d) What is the cost of the work-in-process inventory in the Finishing Department? (For final answer: 1,000 No Peso Sign, No Letters, No Decimal)

Expert Answer:

Posted Date:

Students also viewed these accounting questions

-

MIRR and NPV Your company is considering two mutually exclusive projects, X and Y , whose costs and cash flows are shown below: Year X Y 0 - $ 5 , 0 0 0 - $ 5 , 0 0 0 1 1 , 0 0 0 4 , 5 0 0 2 1 , 5 0...

-

A humanitarian aid operation in Somalia requires supplies to be delivered to three inland locations named 1, 2, and 3, whose demands are 500, 600, and 450 tons respectively. The deliveries can come...

-

Producer manufactures a single product. Its operations are a continuing process carried on in two departments: machining and finishing. In the production process, materials are added to the product...

-

The Assembly Department of Interface, Inc., manufacturer of computers, had 4500 units of beginning inventory in September, and 8000 units wore transferred to it from the Production Department. The...

-

AP tests: Advanced Placement (AP) tests are graded on a scale of 1 (low) through 5 (high). The College Board reported that the distribution of scores on the AP Statistics Exam in 2009 was as follows:...

-

Naggpawh fabrics have issued a 30 year par value bond that is callable in 5 years. If the coupon rate is 5.5% payable semi-annually, what is this bond's yield to call if the yield to maturity is 8%...

-

Lue Gifts uses a sales journal, a purchases journal, a cash receipts journal, a cash disbursements jour nal, and a general journal as illustrated in this chapter. Journalize its November transactions...

-

When Brunos basis in his LLC interest is $150,000, he receives cash of $55,000, a proportionate share of inventory, and land in a distribution that liquidates both the LLC and his entire LLC...

-

Question 1 of 3 View Policies < > Current Attempt in Progress -/1 Appliance Possible Inc. (AP) is a manufacturer of toaster ovens. To improve control over operations, the president of AP wants to...

-

Ten years ago, Spencer began a new business venture with Robert. Spencer owns 70 percent of the outstanding stock, and Robert owns 30 percent. The business has had some difficult times, but current...

-

For MeriDen Company, variable costs are \(60 \%\) of sales, and fixed costs are \(\$ 195,000\). Management's net income goal is \(\$ 75,000\). Compute the required sales in dollars needed to achieve...

-

Turgro Corp. had total variable costs of \(\$ 180,000\), total fixed costs of \(\$ 160,000\), and total revenues of \(\$ 300,000\). Compute the required sales in dollars to break even.

-

In 2008, Hadicke Company had a break-even point of \(\$ 350,000\) based on a selling price of \(\$ 7\) per unit and fixed costs of \(\$ 105,000\). In 2009 , the selling price and the variable cost...

-

Utech Company bottles and distributes Livit, a diet soft drink. The beverage is sold for 50 cents per 16-ounce bottle to retailers, who charge customers 75 cents per bottle. For the year 2010,...

-

A recent balance sheet for The Quaker Oats Company included the following accrued expenses as liabilities: The net income for The Quaker Oats Company for the year was \($284,500,000\). a. If the...

-

Sharp Screen Films, Incorporated, is developing its annual financial statements at December 31, current year. The statements are complete except for the statement of cash flows. The completed...

-

In the series connection below, what are the respective power consumptions of R, R2, and R3? R R www 4 V=6V P1-3 W; P2=3W; and P3= 3 W OP10.5 W; P2-1 W; and P3= 1.5 W P1=1.5 W; P2=1 W; and P3= 0.5 W...

-

Should governments be the principal sources of assistance for economic development and poverty reduction, or should philanthropy play the leading role? What are the advantages and disadvantages of...

-

If McDonald's hamburger prices properly measure purchasing power parity in different countries, data from Exhibit 3.4 could be used to determine proper foreign exchange rates based on the law of one...

-

Money and foreign exchange markets in London and New York are very efficient. You have the following information: Assuming parity conditions hold: a. Estimate inflation in the United States next...

Study smarter with the SolutionInn App