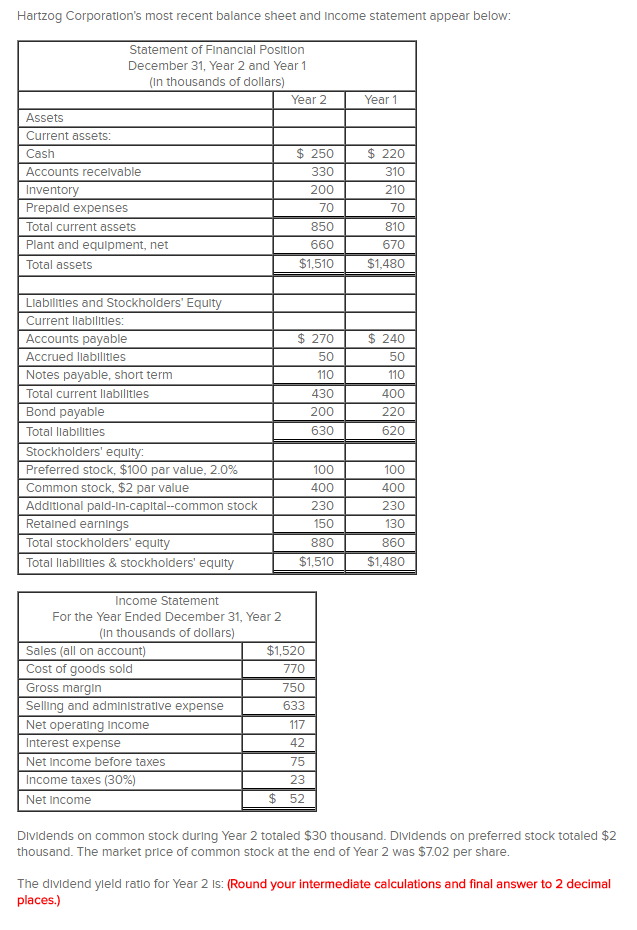

Question: The dividend yield ratio for Year 2 is: (Round your intermediate calculations and final answer to 2 decimal places.) 0.23% 0.30% 2.14% 2.37% Hartzog Corporatlon's

| The dividend yield ratio for Year 2 is: (Round your intermediate calculations and final answer to 2 decimal places.) |

0.23%

0.30%

2.14%

2.37%

Hartzog Corporatlon's most recent balance sheet and Income statement appear below: Statement of Financlal Positlon December 31, Year 2 and Year 1 (In thousands of dollars) Assets Current assets: Cash 250 220 330 310 Accounts receIvable Inventory 200 210 70 Prepaid expenses Total current asset 850 810 Plant and equlpment, net 670 SM Total assets ILIablitles and Stockholders Equty Current lab lties: Accounts payable 270 240 Accrued lablittle 500 50 110 10 Notes payable, short term Total current liablitl 430 400 Total liablites 630 620 ders' equity Preferred Stock.$100 par value, 2.0% 100 1000 Common stock. S2 par value 400 400 I pald-In-capital--common stock 230 230 50 130 Retained earnings Total Stockholders equit 880 860 Total liabilitles & stockholders' equlty $1,510 $1,480 Income Statement For the Year Ended December 31, Year 2 (In thousands of dollars) $1.520 Sales (all on account) Cost goods sold 770 Gross margin 750 Selling and administratve expense 6633 Net Operating Income 117 Interest expense 42 NetIncome before taxes 75 Income taxes 30% 23 52 Net Income DIvidends on common stock durIng Year 2 totaled $30 thousand. Dlvldends on preferred stock totaled $2 thousand. The market price of common stock at the end of Year 2 was $7.02 per share The dividend yleld ratlo for Year 2 ls: (Round your intermediate calculations and final answer to 2 decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts