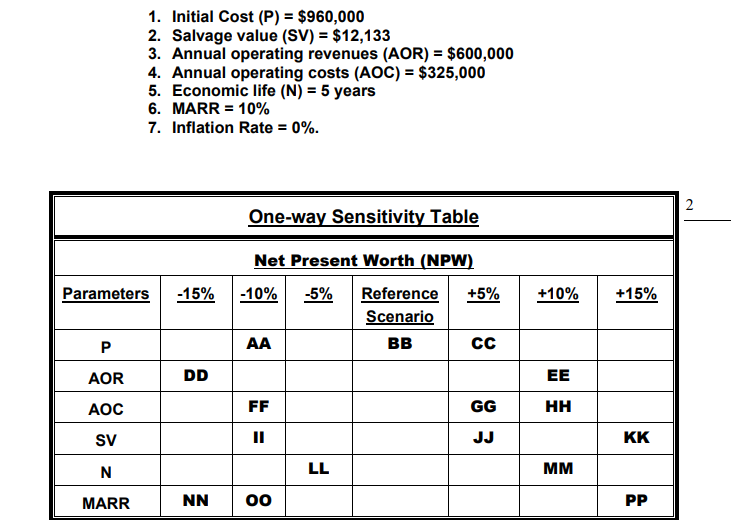

Question: ' The dollar value cell EE is between options: 286,600 and 286,100 317,300 and 317,800 297,400 and 297,900 248,800 and 249,300 The dollar value cell

'

The dollar value cell EE is between

options:

286,600 and 286,100

317,300 and 317,800

297,400 and 297,900

248,800 and 249,300

The dollar value cell FF is between

options:

285,700 and 286,200

213,100 and 213,600

207,200 and 207,700

246,800 and 247,300

The dollar value cell GG is between

options:

28,100 and 28,600

19,400 and 19,900

35,700 and 36,200

56,800 and 57,300

The dollar value cell HH is between

Options:

-33,500 and -33,000

-19,400 and -18,900

30,100 and 30,600

-25,700 and -25,100

Please give me the answers -

1. Initial Cost (P) = $960,000 2. Salvage value (SV) = $12,133 3. Annual operating revenues (AOR) = $600,000 4. Annual operating costs (AOC) = $325,000 5. Economic life (N) = 5 years 6. MARR = 10% 7. Inflation Rate = 0%. One-way Sensitivity Table Net Present Worth (NPW) Parameters -15% -10% -5% +5% +10% +15% Reference Scenario BB P AA CC AOR DD EE AOC FF GG HH SV II JJ KK N LL MM MARR NN oo PP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts