Question: The down below is three multi questions, please show me the detail of process, have no idea how to do them. Thanks a lot A

The down below is three multi questions, please show me the detail of process, have no idea how to do them. Thanks a lot

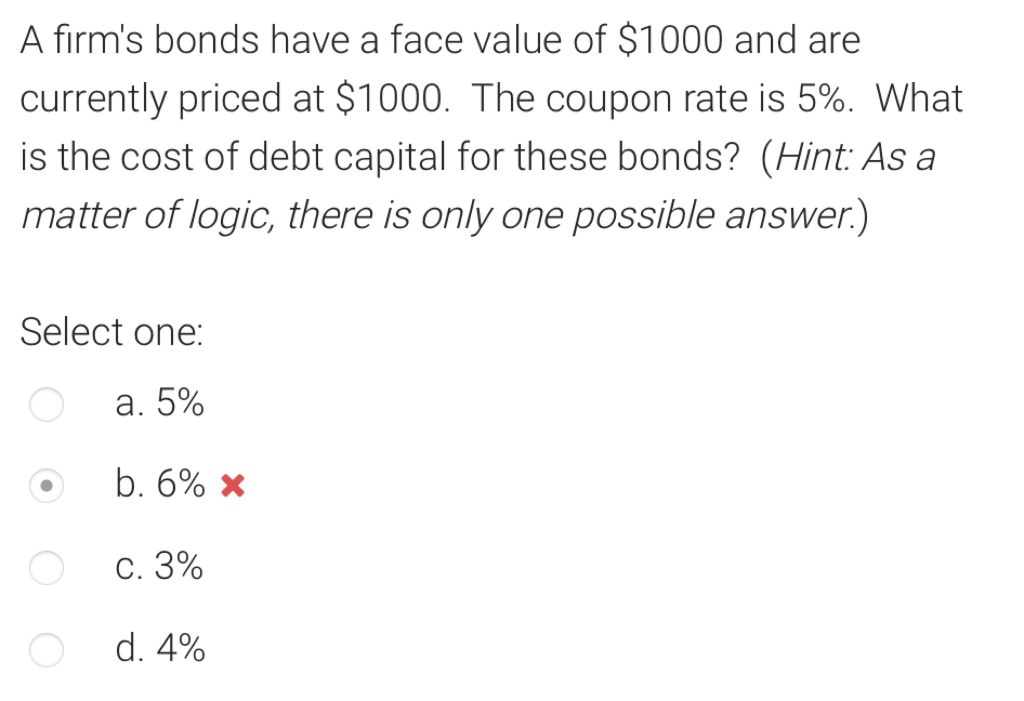

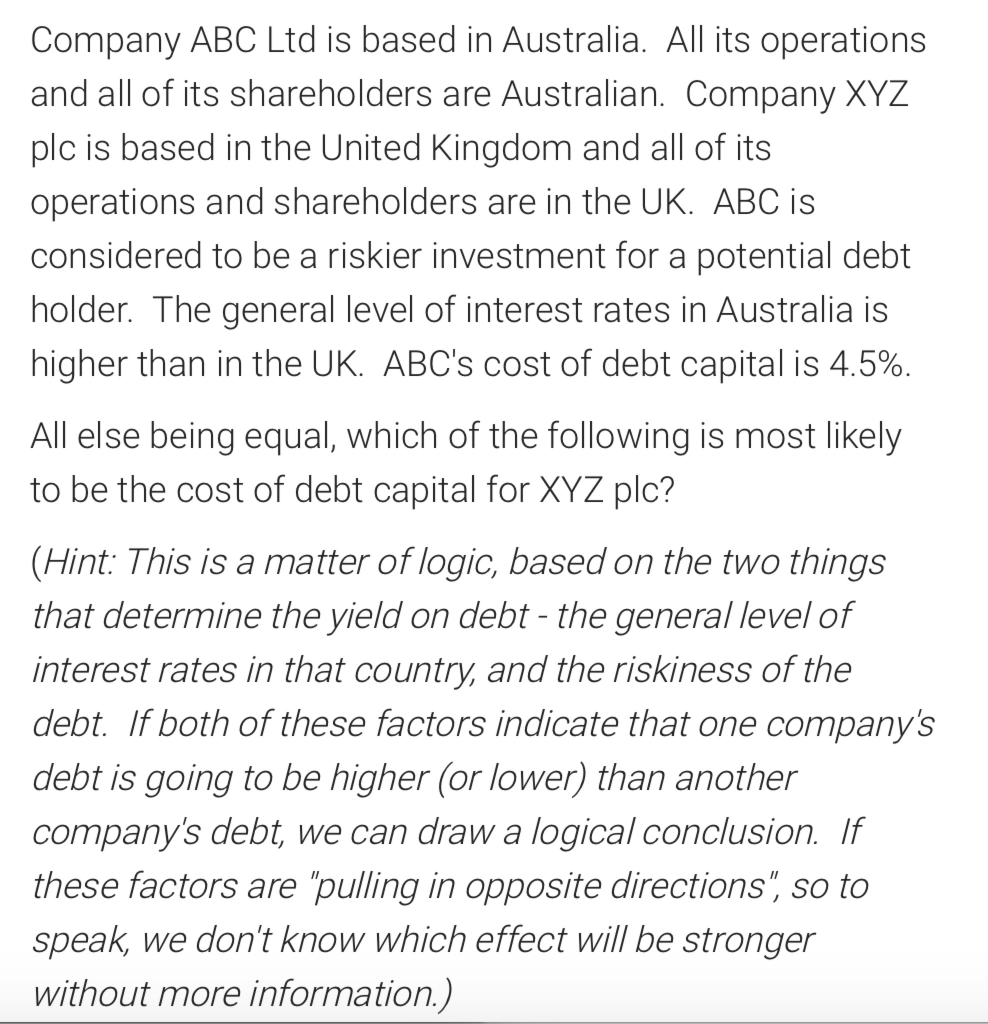

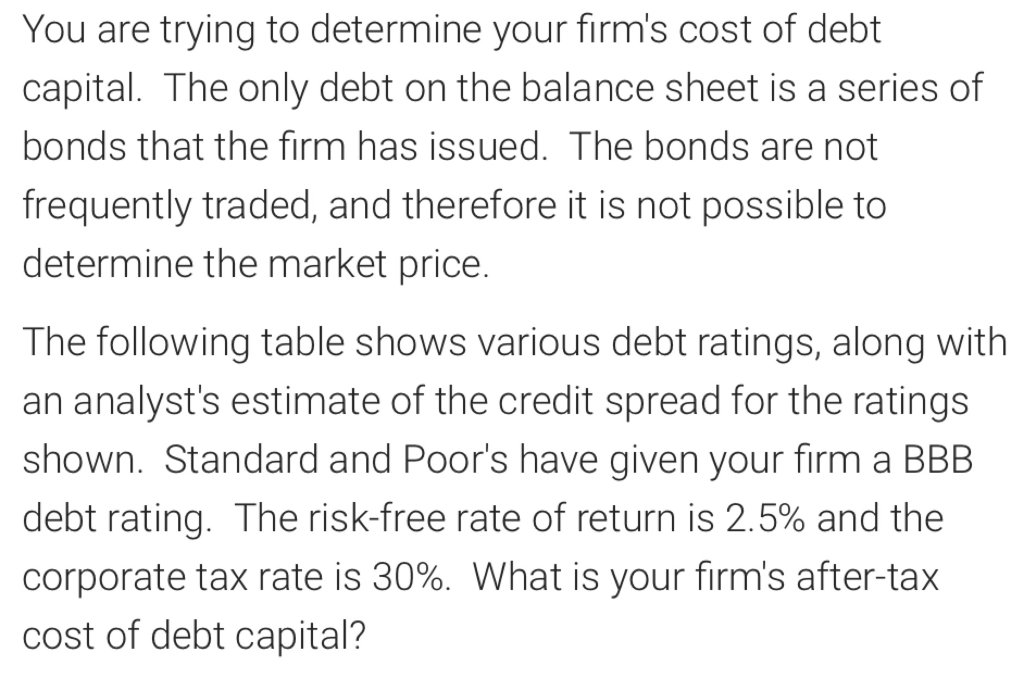

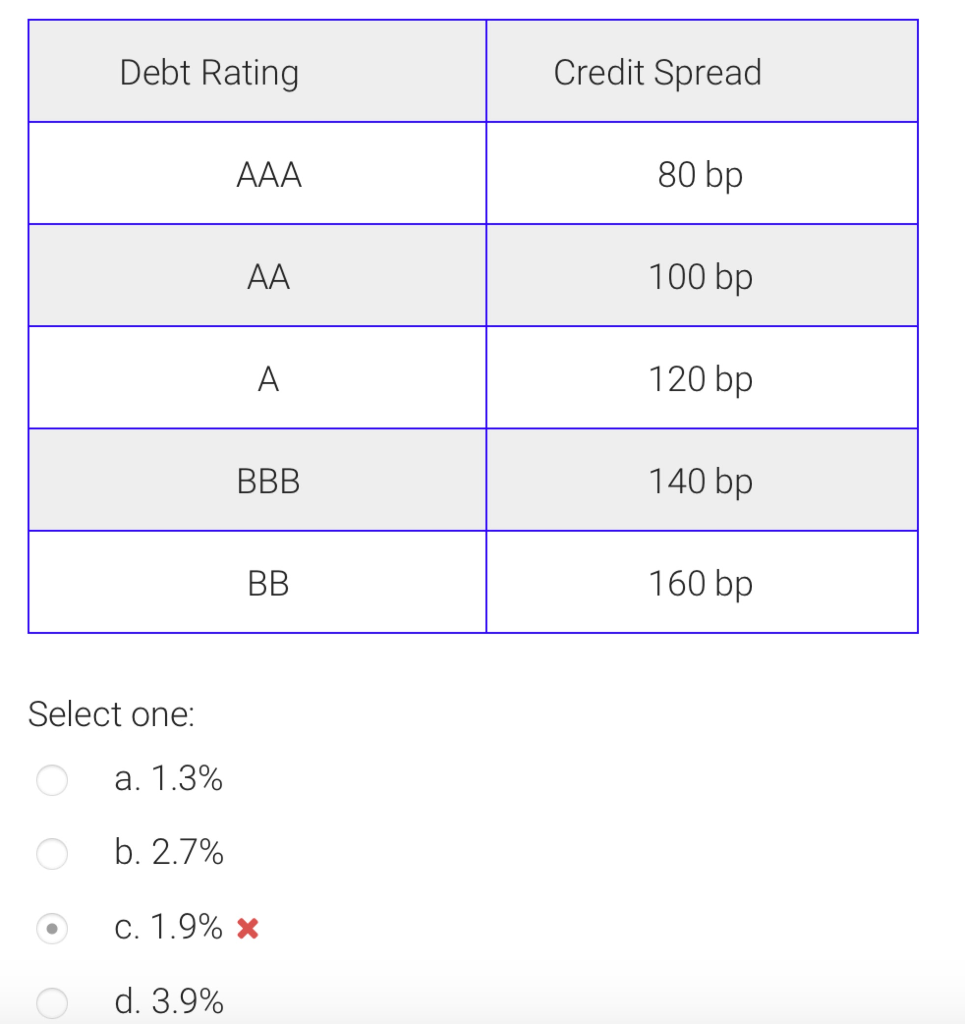

A firm's bonds have a face value of $1000 and are currently priced at $1000. The coupon rate is 5%. What is the cost of debt capital for these bonds? (Hint: As a matter of logic, there is only one possible answer.) Select one: a. 5% b. 6% x . 3% d. 4% Company ABC Ltd is based in Australia. All its operations and all of its shareholders are Australian. Company XYZ plc is based in the United Kingdom and all of its operations and shareholders are in the UK. ABC is considered to be a riskier investment for a potential debt holder. The general level of interest rates in Australia is higher than in the UK. ABC's cost of debt capital is 4.5%. All else being equal, which of the following is most likely to be the cost of debt capital for XYZ plc? (Hint: This is a matter of logic, based on the two things that determine the yield on debt - the general level of interest rates in that country, and the riskiness of the debt. If both of these factors indicate that one companys debt is going to be higher (or lower) than another company's debt, we can draw a logical conclusion. If these factors are pulling in opposite directions, so to speak, we don't know which effect will be stronger without more information.) Select one: a. Impossible to estimate without more information about interest rates and relative riskiness. b. 5.2% C. 3.5% d. 4.5% You are trying to determine your firm's cost of debt capital. The only debt on the balance sheet is a series of bonds that the firm has issued. The bonds are not frequently traded, and therefore it is not possible to determine the market price. The following table shows various debt ratings, along with an analyst's estimate of the credit spread for the ratings shown. Standard and Poor's have given your firm a BBB debt rating. The risk-free rate of return is 2.5% and the corporate tax rate is 30%. What is your firm's after-tax cost of debt capital? Debt Rating Credit Spread 80 bp 100 bp 120 bp 140 bp 160 bp Select one: a. 1.3% C. 1.9% X d. 3.9%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts