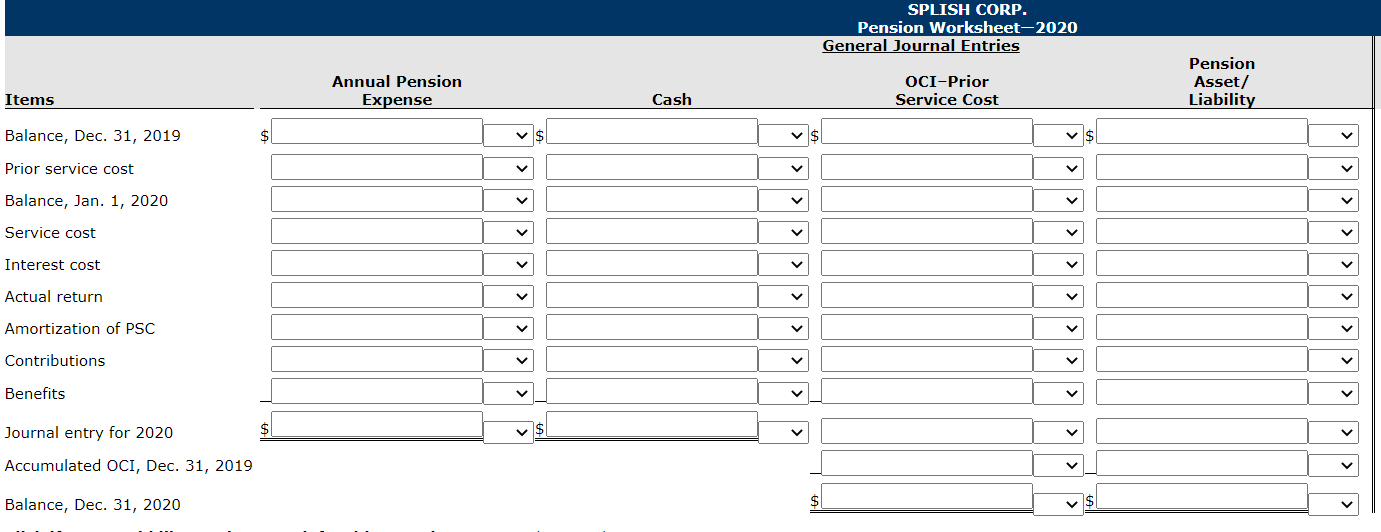

Question: The drop down menu on the side of each entry has an option of Debit or Credit The following defined pension data of Splish Corp.

The drop down menu on the side of each entry has an option of Debit or Credit

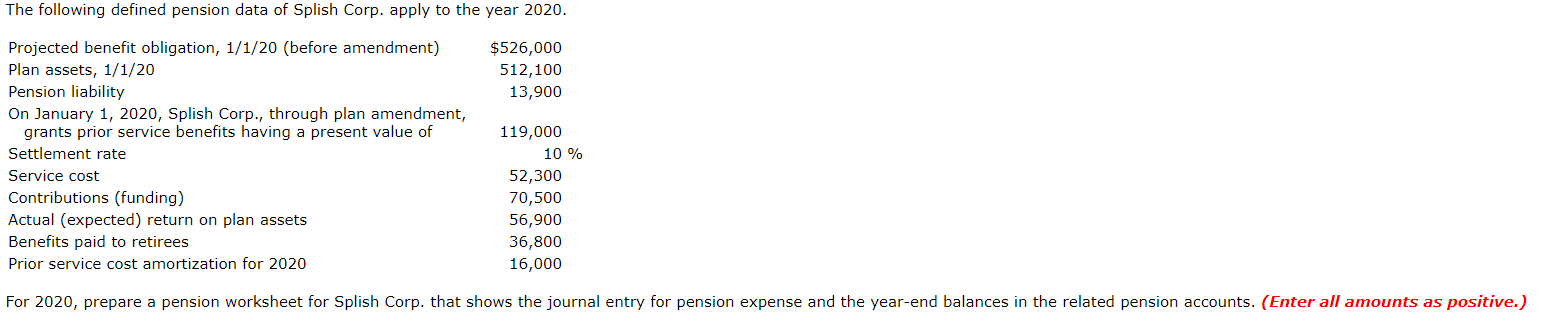

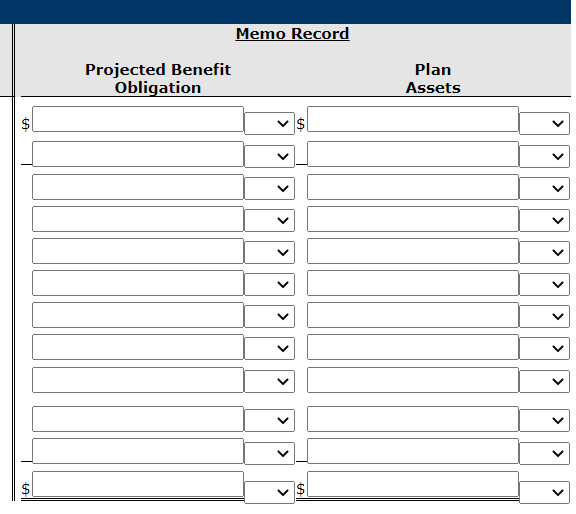

The following defined pension data of Splish Corp. apply to the year 2020. $526,000 512,100 13,900 Projected benefit obligation, 1/1/20 (before amendment) Plan assets, 1/1/20 Pension liability On January 1, 2020, Splish Corp., through plan amendment, grants prior service benefits having a present value of Settlement rate Service cost Contributions (funding) Actual (expected) return on plan assets Benefits paid to retirees Prior service cost amortization for 2020 119,000 10 % 52,300 70,500 56,900 36,800 16,000 For 2020, prepare a pension worksheet for Splish Corp. that shows the journal entry for pension expense and the year-end balances in the related pension accounts. (Enter all amounts as positive.) SPLISH CORP. Pension Worksheet-2020 General Journal Entries Annual Pension Expense OCI-Prior Service Cost Pension Asset/ Liability Items Cash Balance, Dec. 31, 2019 $ Prior service cost Balance, Jan. 1, 2020 Service cost Interest cost Actual return Amortization of PSC Contributions Benefits Journal entry for 2020 $ Accumulated OCI, Dec. 31, 2019 Balance, Dec. 31, 2020 Memo Record Projected Benefit Obligation Plan Assets $

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts