Question: the drop down options are correct and incorrect 10 (CHAPTER 9) Yes Invest JOO No Your company has an investment opportunity, and it is trying

the drop down options are correct and incorrect

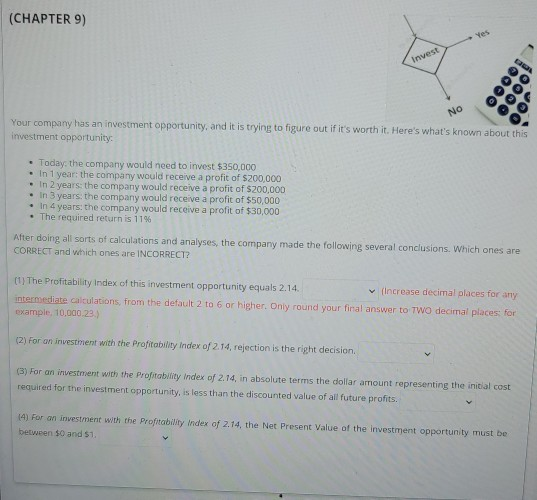

10 (CHAPTER 9) Yes Invest JOO No Your company has an investment opportunity, and it is trying to figure out if it's worth it. Here's what's known about this investment opportunity . Today, the company would need to invest $350,000 In 1 year: the company would receive a profit of $200,000 - In 2 years: the company would receive a profit of $200,000 In 3 years, the company would receive a profit of $50,000 In 4 years the company would receive a profit of $30,000 The required return is 11% After doing all sorts of calculations and analyses, the company made the following several conclusions. Which ones are CORRECT and which ones are INCORRECT? (1) The Profitability Index of this investment opportunity equals 2.14. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places for example, 10,000.22 (2) For an investment with the Profitability Index of 2.14, rejection is the right decision (3) For an investment with the Profitability Index of 2.14, in absolute terms the dollar amount representing the initial cost required for the investment opportunity, is less than the discounted value of all future profits. 14) For an investment with the Profitability Index of 2.14, the Net Present Value of the investment opportunity must be between 50 and 51

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts