Question: Your answer: Question 3 (CHAPTER 10) Your boss is considering a 5-year investment project. If the project is accepted, it would require an immediate spending

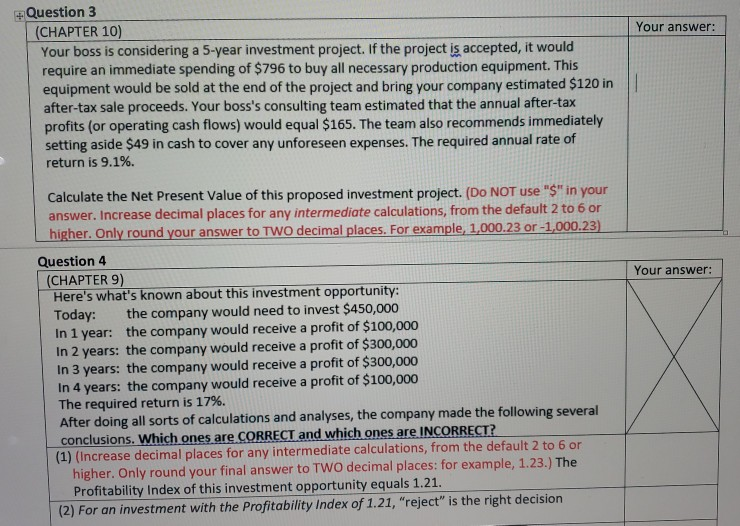

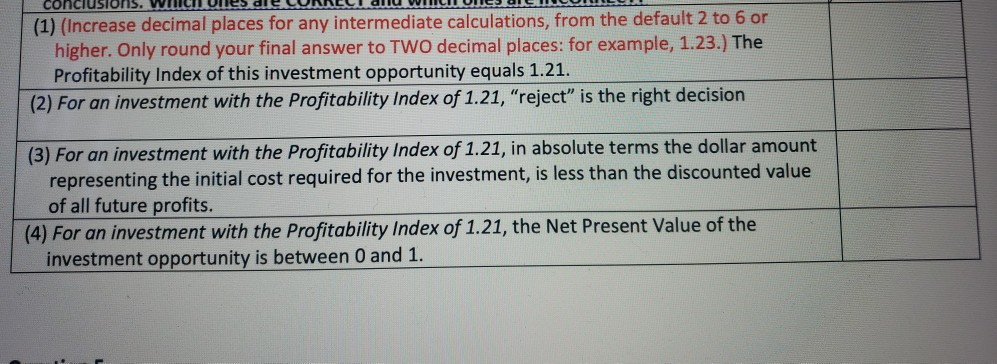

Your answer: Question 3 (CHAPTER 10) Your boss is considering a 5-year investment project. If the project is accepted, it would require an immediate spending of $796 to buy all necessary production equipment. This equipment would be sold at the end of the project and bring your company estimated $120 in after-tax sale proceeds. Your boss's consulting team estimated that the annual after-tax profits (or operating cash flows) would equal $165. The team also recommends immediately setting aside $49 in cash to cover any unforeseen expenses. The required annual rate of return is 9.1%. Your answer: Calculate the Net Present Value of this proposed investment project. (Do NOT use"" in your answer. Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your answer to TWO decimal places. For example, 1,000.23 or -1,000.23) Question 4 (CHAPTER 9) Here's what's known about this investment opportunity: Today: the company would need to invest $450,000 In 1 year: the company would receive a profit of $100,000 In 2 years: the company would receive a profit of $300,000 In 3 years: the company would receive a profit of $300,000 In 4 years: the company would receive a profit of $100,000 The required return is 17%. After doing all sorts of calculations and analyses, the company made the following several conclusions. Which ones are CORRECT and which ones are INCORRECT? (1) (Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 1.23.) The Profitability Index of this investment opportunity equals 1.21. (2) For an investment with the Profitability Index of 1.21, "reject" is the right decision CORCUEIL COLOUCULLU VINCUL UNICO SU (1) (Increase decimal places for any intermediate calculations, from the default 2 to 6 or higher. Only round your final answer to TWO decimal places: for example, 1.23.) The Profitability Index of this investment opportunity equals 1.21. (2) For an investment with the Profitability Index of 1.21,"reject" is the right decision (3) For an investment with the Profitability Index of 1.21, in absolute terms the dollar amount representing the initial cost required for the investment, is less than the discounted value of all future profits. (4) For an investment with the Profitability Index of 1.21, the Net Present Value of the investment opportunity is between 0 and 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts