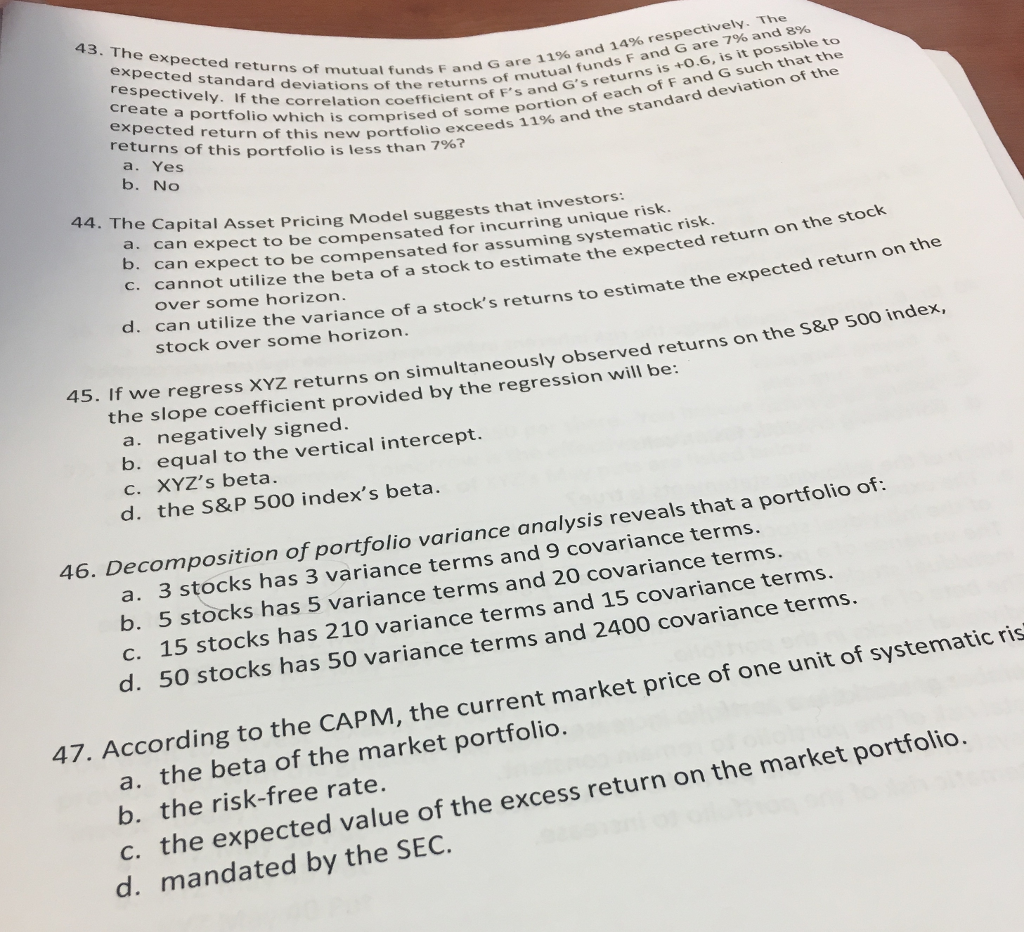

Question: The e expected standard deviations of the ret The expected returns of mutual funds F ans of mutis retfFana ivly. If the correlation coefficient o

The e expected standard deviations of the ret The expected returns of mutual funds F ans of mutis retfFana ivly. If the correlation coefficient o and G are 11% and 14% respectively. The ate a portfolio which is comprised of some expected return of this new portfolio excee rns of mutual funds F and G are 7% and 8% portion of each of F and G such that the 11% and the standard deviation of the F's and G's ret urns is +0.6, is it possible to returns of this portfolio is less than 7 a. Yes b. No 44. The Capital A sset Pricing Model suggests that investors expect to be compensated for incurring unique risk. . can ca n expect to be compensated for assuming systematic risk over some horizon. stock over some horizon. cannot utilize the beta of a stock to estimate the expected return on the stock d ret d. can utilize the variance of a stock's returns to est mate the expected return on the 45. If we regress XYZ returns on simultaneously obs erved returns on the S&P 500 index, the slope coefficient provided by the regression will be: a. negatively signed. b. equal to the vertical intercept. C. XYZ's beta. d. the S&P 500 index's beta. 46. Decomposition of portfolio v arian ce analysis reveals that a portfolio of: a. 3 stocks has 3 variance terms and 9 covariance terms. b. 5 stocks has 5 variance terms and 20 covariance terms. c. 15 stocks has 210 variance terms and 15 covariance terms. d. 50 stocks has 50 varianc e terms and 2400 covariance terms one u nit of systematic ris 47. According to the CAPM, the current market price of a. the beta of the market portfolio. b. the risk-free rate c. the expec d. mandated by the SEC. . ted value of the excess return on the market portfolio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts