Question: The EV batteries' target market will include individuals characterized based on income, behaviors, age, and psychological attributes. The product will target individuals with a high

The EV batteries' target market will include individuals characterized based on income, behaviors, age, and psychological attributes. The product will target individuals with a high income between $50,000 and above. The product targets people within high and middle-income brackets because of the high cost of the batteries. Some individuals within the high income

bracket also prefer using electric vehicles as a symbol of their wealth, thus making them appropriate target customers for the new EV batteries. The product will also target individuals living in urban centers. Electric batteries need to be recharged at a certified charging point. The electric vehicle charging stations are distributed based on the availability of users. Therefore,

most stations are located in urban centers because there are many electric vehicles in the urban centers. Therefore, our product will target electric vehicle car owners in the cities. However, we will also consider electric vehicle owners in the outskirts of the urban centers who need longrange batteries based on their proximity to the charging stations. The age bracket of our target customers will be diverse because electric vehicles have gained popularity among people of different ages. However, our main target will be young adults and middle-aged individuals because they are likely to try out new things. According to Finlay (2022), there has been a trend toward purchasing electric cars among young people because of the rising fuel cost. Millenials are also eager to own an electric vehicle as a status symbol among their peers and society.

Therefore, younger adults may constitute the largest part of our target market.

The product will also target individuals interested in protecting the environment and those who support the move toward green energy. According to Luo & Qiu (2020), electric vehicles have a high potential to reduce greenhouse gas emissions, increase energy efficiency and diversify energy sources. Therefore, our product will attract customers interested in protecting the environment because of their vital role in reducing greenhouse gases that contribute to environmental issues such as global warming and climate change. Another behavior we will consider when selecting the target market is the consciousness of fuel costs. We will target individuals concerned about the rising fuel cost and those looking for alternative sources of energy because they will not be using fuel. We will also target technological-oriented individuals. Electric vehicle batteries use technology to power vehicles, thus making them appealing to individuals who love technology. We will also implement the ideas of technology savvy customers to improve the product to increase customer loyalty. The psychological profile of the target customers will include individuals who purchase car batteries because of maintenance and battery longevity. Our new batteries will have more energy capacity, thus lasting longer without recharging. Therefore, customers who consider battery longevity will be attracted to the product. We will also attract customers who focus on maintenance by providing durable batteries and reducing the need to charge the batteries constantly. Our product will also target individuals who associate electric vehicles with wealth and a high status in society because they will be interested in getting the best electric vehicle batteries for their cars to cover more distance than other individuals with similar electric vehicles so that they can maintain a higher status.

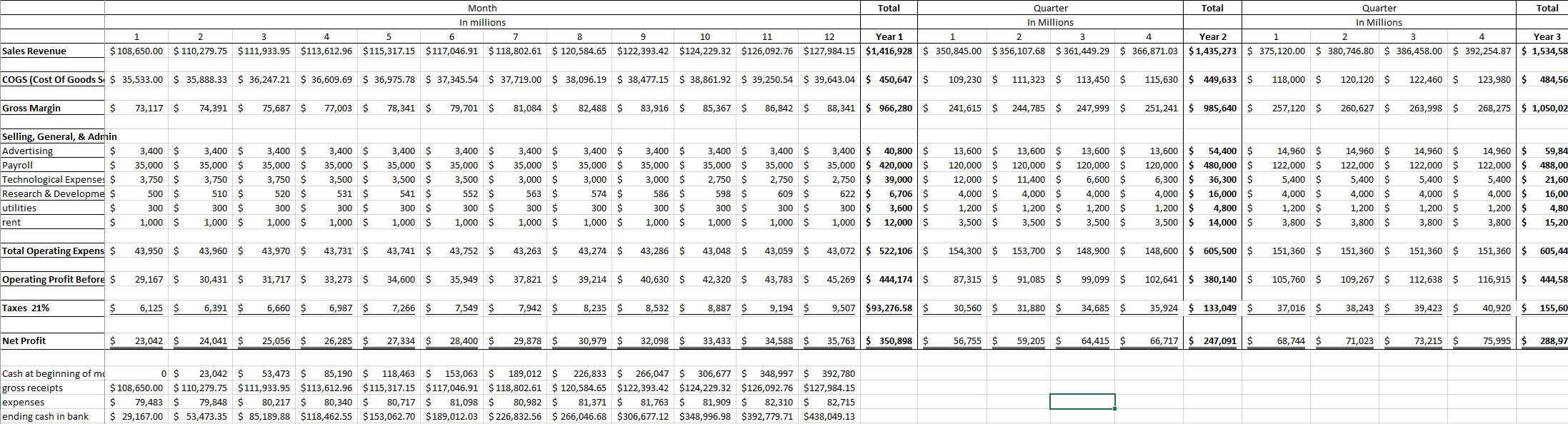

- Describe how you developed the pro forma projected expenses and operating costs.

- Explain your revenue estimates, variable costs, fixed costs, margin, and how your arrived at your figures. Pro Forma Spreadsheet:

Sales Revenue 1 2 Month In millions 3 4 5 6 7 8 9 10 11 12 Year 1 1 Quarter In Millions 2 3 4 Year 2 1 Quarter In Millions 2 3 4 Year 3 $108,650.00 $ 110,279.75 $111,933.95 $113,612.96 $115,317.15 $117,046.91 $118,802.61 $ 120,584.65 $122,393.42 $124,229.32 $126,092.76 $127,984.15 $1,416,928 $ 350,845.00 $356,107.68 $361,449.29 $ 366,871.03 $1,435,273 $ 375,120.00 $380,746.80 $ 386,458.00 $ 392,254.87 $ 1,534,58 Total Total Total COGS (Cost Of Goods S $ 35,533.00 $ 35,888.33 $ 36,247.21 $ 36,609.69 $ 36,975.78 $ 37,345.54 $ 37,719.00 $ 38,096.19 $ 38,477.15 $ 38,861.92 $ 39,250.54 $ 39,643.04 $ 450,647 $ 109,230 $ 111,323 $ 113,450 $ 115,630 $449,633 $ 118,000 $ 120,120 $ 122,460 $ 123,980 $ 484,56 Gross Margin $ 73,117 $ 74,391 $ 75,687 $ 77,003 $ 78,341 $ 79,701 $ 81,084 $ 82,488 $ 83,916 $ 85,367 $ 86,842 $ 88,341 $966,280 $ 241,615 $ 244,785 $ 247,999 $ 251,241 $985,640 $ 257,120 $ 260,627 $ 263,998 $ 268,275 $1,050,02 Selling, General, & Admin Advertising $ Payroll $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 $ 35,000 $ 3,400 35,000 $ Technological Expenses $ 3,750 $ 3,750 $ 3,750 $ 3,500 $ 3,500 $ 3,500 $ 3,000 $ 3,000 $ 3,000 $ 3,400 $ 35,000 $ 2,750 $ 3,400 $ 35,000 $ 2,750 $ 3,400 $40,800 $ 35,000 $420,000 $ 2,750 $ 39,000 $ 13,600 $ 120,000 $ 13,600 $ 120,000 $ 13,600 $ 120,000 $ 12,000 $ 11,400 $ 6,600 $ 13,600 $ 54,400 $ 120,000 $480,000 $ 6,300 $ 36,300 $ Research & Developme $ 14,960 $ 122,000 $ 5,400 $ 14,960 $ 122,000 $ 5,400 $ 14,960 $ 122,000 $ 14,960 $ 59,84 122,000 5,400 $ 5,400 $ 500 $ $488,00 21,60 510 $ 520 $ 531 $ 541 $ 552 $ 563 $ 574 $ 586 $ 598 $ 609 $ 622 $ 6,706 $ 4,000 $ 4,000 $ 4,000 $ 4,000 $ 16,000 $ 4,000 $ 4,000 $ utilities rent 4,000 $ $ 300 $ 300 $ 300 $ 300 $ 4,000 $ 16,00 300 $ 300 $ 300 $ 300 $ 300 $ $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 1,000 $ 300 $ 1,000 $ 300 $ 300 $ 3,600 $ 1,200 $ 1,200 $ 1,200 $ 1,200 $ 4,800 $ 1,200 $ 1,200 $ 1,200 $ 1,200 $ 4,80 1,000 $ 1,000 $12,000 $ 3,500 $ 3,500 $ 3,500 $ 3,500 $14,000 $ 3,800 $ 3,800 $ 3,800 $ 3,800 $ 15,20 Total Operating Expens $ 43,950 $ 43,960 $ 43,970 $ 43,731 $ 43,741 $ 43,752 $ 43,263 $ 43,274 $ 43,286 $ 43,048 $ 43,059 $ 43,072 $522,106 $ 154,300 $ 153,700 $ 148,900 $ 148,600 $ 605,500 $ 151,360 $ 151,360 $ 151,360 $ 151,360 $605,44 Operating Profit Before $ 29,167 $ 30,431 $ 31,717 $ 33,273 $ 34,600 $ 35,949 $ 37,821 $ 39,214 $ 40,630 $ 42,320 $ 43,783 $ 45,269 $444,174 $ 87,315 $ 91,085 $ 99,099 $ 102,641 $ 380,140 $ 105,760 $ 109,267 $ 112,638 $ 116,915 $ 444,58 Taxes 21% $ 6,125 $ 6,391 $ 6,660 $ 6,987 $ 7,266 $ 7,549 $ 7,942 $ 8,235 $ 8,532 $ 8,887 $ 9,194 $ 9,507 $93,276.58 $ 30,560 $ 31,880 $ 34,685 $ 35,924 $ 133,049 $ 37,016 $ 38,243 $ 39,423 $ 40,920 $ 155,60 Net Profit $ 23,042 $ 24,041 $ 25,056 $ 26,285 $ 27,334 $ 28,400 $ 29,878 $ 30,979 $ 32,098 $ 33,433 $ 34,588 $ 35,763 $350,898 $ 56,755 $ 59,205 $ 64,415 $ 66,717 $247,091 $ 68,744 $ 71,023 $ 73,215 $ 75,995 $288,97 0 $ 23,042 $ 53,473 $ 85,190 $ 118,463 $ Cash at beginning of mo gross receipts expenses ending cash in bank 153,063 $ 189,012 $ 226,833 $266,047 $ 306,677 $348,997 $ 392,780 $108,650.00 $ 110,279.75 $111,933.95 $113,612.96 $115,317.15 $117,046.91 $118,802.61 $ 120,584.65 $122,393.42 $124,229.32 $126,092.76 $127,984.15 $ 79,483 $ 79,848 $ 80,217 $ 80,340 $ 80,717 $ 81,098 $ 80,982 $ 81,371 $ 81,763 81,909 $ 82,310 $ 82,715 $ 29,167.00 $ 53,473.35 $ 85,189.88 $118,462.55 $153,062.70 $189,012.03 $226,832.56 $266,046.68 $306,677.12 $348,996.98 $392,779.71 $438,049.13

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts