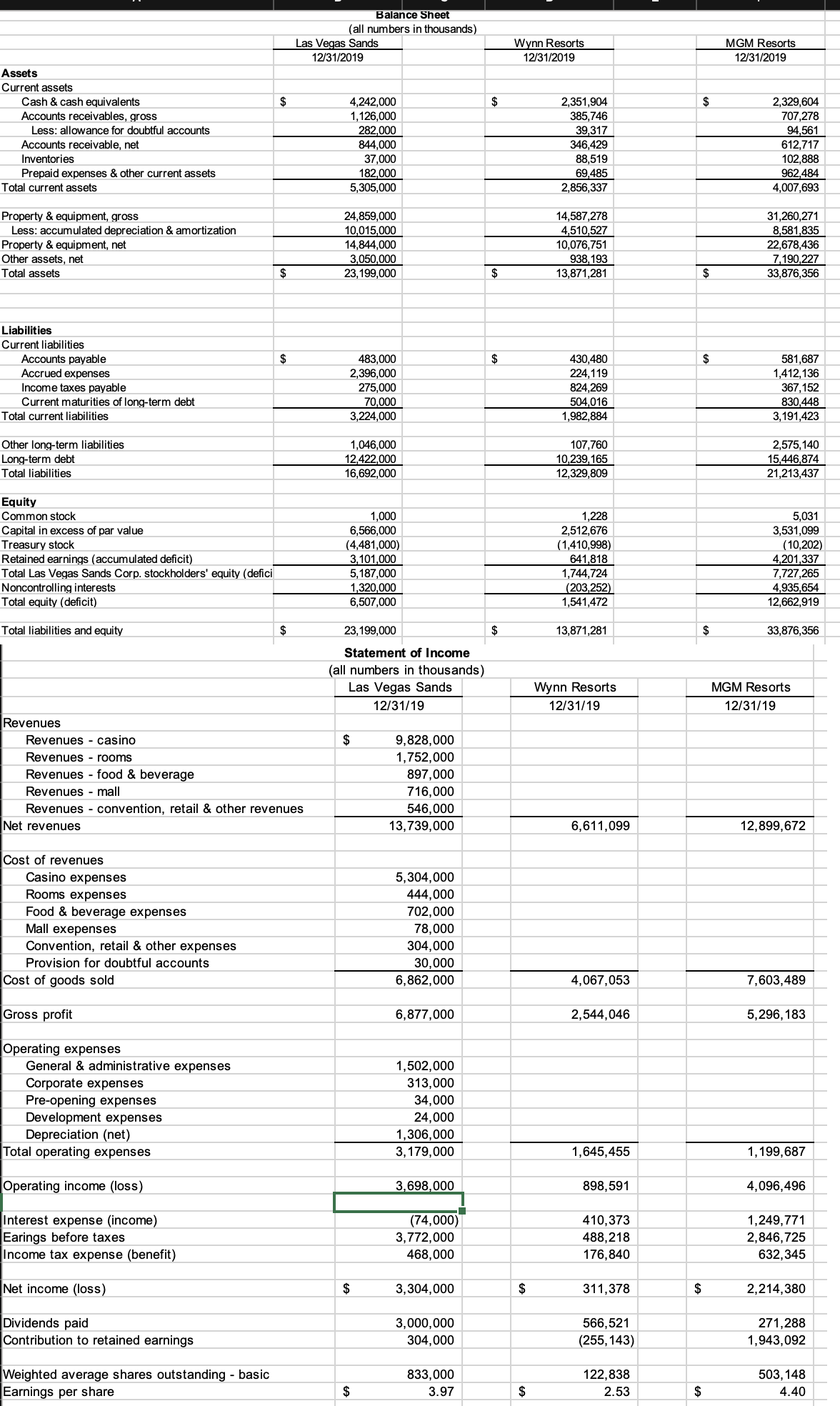

Question: The exercise has the following situation and is being solved for Las Vegas Sands: Concerns have been raised regarding our current cost structure ( our

The exercise has the following situation and is being solved for Las Vegas Sands:

Concerns have been raised regarding our current cost structure our means Las Vegas Sands Company Next week, I anticipate management will be meeting to discuss our marginsmarkup and how they do or do not fit with our strategic positioning.

Using our financial statements and ratio analysis, please assess our current state. Compare our cost structure to our lowerend competition ie MGM Resorts and our higherend competition ie Wynn Resorts Please provide any recommendations on our

current positioning. Additionally, management would like to keep continual tabs on our other benchmarks.

Identify any concerns with our current ratio, times interest earned ratio, and inventory turnover ratio. Please provide any evaluation recommendation on these.

Lastly, shareholders and therefore management are very concerned with maintaining a competitive returnonequity relative to our industry peers. Calculate ours and our peers ROE and use a threepart du Pont analysis to provide recommendations on areas of strength or room for improvement.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock