Question: The expected return for asset A is 7.00% with a standard deviation of 7.00%, and the expected return for asset B is 6.00% with a

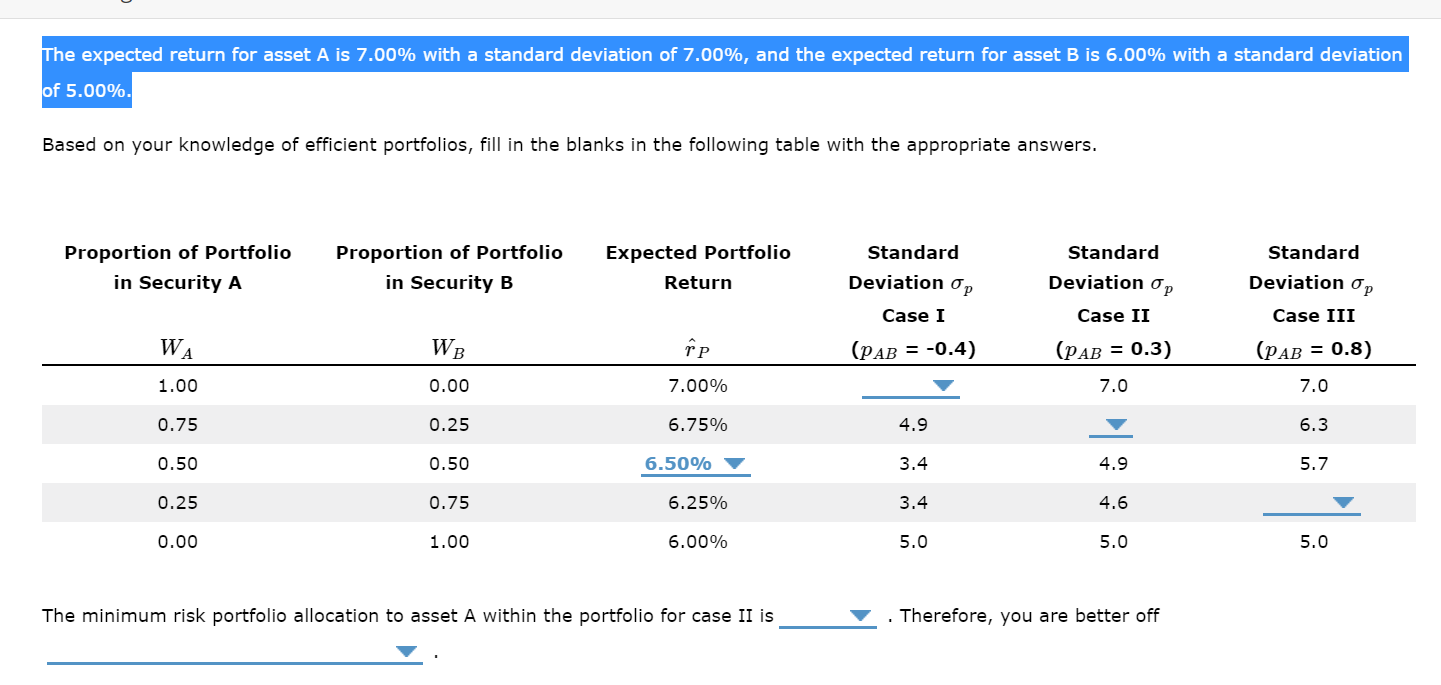

The expected return for asset A is 7.00% with a standard deviation of 7.00%, and the expected return for asset B is 6.00% with a standard deviation of 5.00%. Based on your knowledge of efficient portfolios, fill in the blanks in the following table with the appropriate answers. Expected Portfolio Standard Standard Standard Proportion of Portfolio in Security A Proportion of Portfolio in Security B Return Deviation op Deviation op Deviation op Case I Case II Case III WA WB p (PAB = -0.4) (PAB = 0.8) (PAB = 0.3) 7.0 1.00 0.00 7.00% 7.0 0.75 0.25 6.75% 4.9 6.3 0.50 0.50 6.50% 3.4 4.9 5.7 0.25 0.75 6.25% 3.4 4.6 0.00 1.00 6.00% 5.0 5.0 5.0 The minimum risk portfolio allocation to asset A within the portfolio for case II is . Therefore, you are better off

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts