Question: The expected return for Zbrite stock calculated using the CAPM is 15.5%. The risk free rate is 3.5% and the beta of the stock is

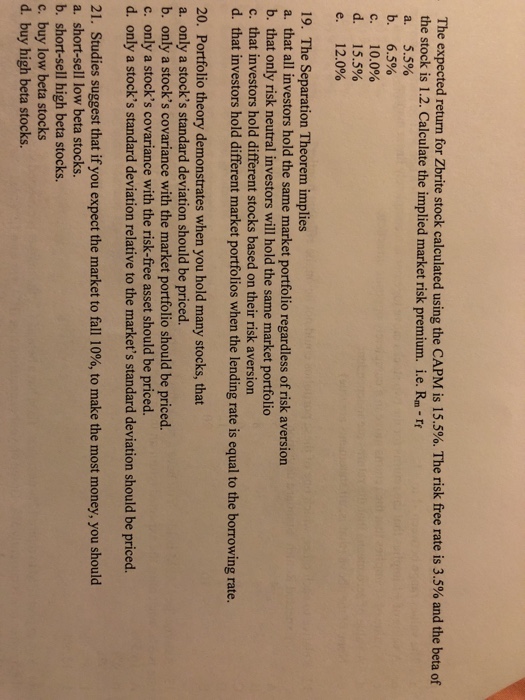

The expected return for Zbrite stock calculated using the CAPM is 15.5%. The risk free rate is 3.5% and the beta of the stock is 1.2. Calculate the implied market risk premium. i.e. Rm-Tr a. 5.5% b. 6.5% c. 10.0% d. 15.5% e. 12.0% 19. The Separation Theorem implies a. that all investors hold the same market portfolio regardless of risk aversion b. that only risk neutral investors will hold the same market portfolio c. that investors hold different stocks based on their risk aversion d. that investors hold different market portfolios when the lending rate is equal to the borrowing rate. 20. Portfolio theory demonstrates when you hold many stocks, that a. only a stock's standard deviation should be priced. b. only a stock's covariance with the market portfolio should be priced. c. only a stock's covariance with the risk-free asset should be priced. d. only a stock's standard deviation relative to the market's standard deviation should be priced. 21. Studies suggest that ifyou expect the market to fall 10%, to make the most money, you should a. short-sell low beta stocks. b. short-sell high beta stocks. c. buy low beta stocks d. buy high beta stocks

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts