Question: The expected return from previous is 10.4% or .1044 Please do 12-15 and show the work. thank you! H. Capital Budgeting Analysis Use your company's

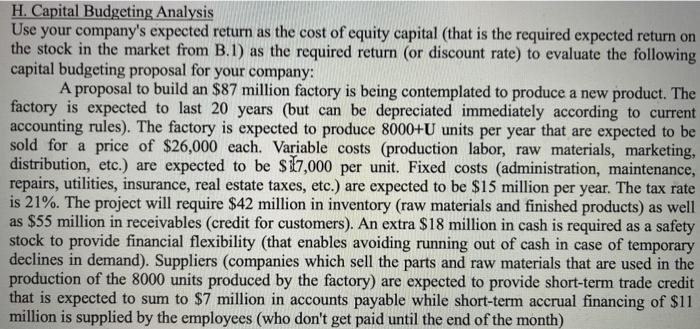

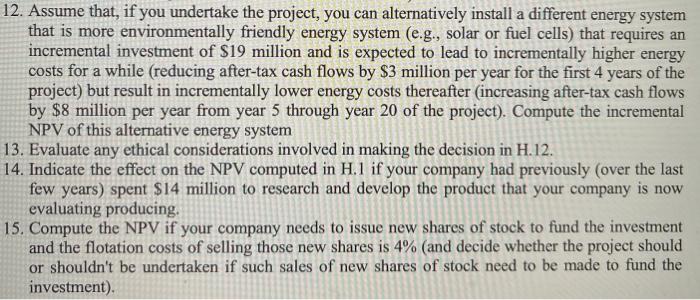

H. Capital Budgeting Analysis Use your company's expected return as the cost of equity capital (that is the required expected return on the stock in the market from B.1) as the required return (or discount rate) to evaluate the following capital budgeting proposal for your company: A proposal to build an $87 million factory is being contemplated to produce a new product. The factory is expected to last 20 years (but can be depreciated immediately according to current accounting rules). The factory is expected to produce 8000+U units per year that are expected to be sold for a price of $26,000 each. Variable costs (production labor, raw materials, marketing, distribution, etc.) are expected to be $ 17,000 per unit. Fixed costs (administration, maintenance, repairs, utilities, insurance, real estate taxes, etc.) are expected to be $15 million per year. The tax rate is 21%. The project will require $42 million in inventory (raw materials and finished products) as well as $55 million in receivables (credit for customers). An extra $18 million in cash is required as a safety stock to provide financial flexibility (that enables avoiding running out of cash in case of temporary declines in demand). Suppliers (companies which sell the parts and raw materials that are used in the production of the 8000 units produced by the factory) are expected to provide short-term trade credit that is expected to sum to $7 million in accounts payable while short-term accrual financing of $11 million is supplied by the employees (who don't get paid until the end of the month) 12. Assume that, if you undertake the project, you can alternatively install a different energy system that is more environmentally friendly energy system (e.g., solar or fuel cells) that requires an incremental investment of $19 million and is expected to lead to incrementally higher energy costs for a while (reducing after-tax cash flows by $3 million per year for the first 4 years of the project) but result in incrementally lower energy costs thereafter (increasing after-tax cash flows by $8 million per year from year 5 through year 20 of the project). Compute the incremental NPV of this alternative energy system 13. Evaluate any ethical considerations involved in making the decision in H.12. 14. Indicate the effect on the NPV computed in H.1 if your company had previously over the last few years) spent $14 million to research and develop the product that your company is now evaluating producing. 15. Compute the NPV if your company needs to issue new shares of stock to fund the investment and the flotation costs of selling those new shares is 4% (and decide whether the project should or shouldn't be undertaken if such sales of new shares of stock need to be made to fund the investment)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts