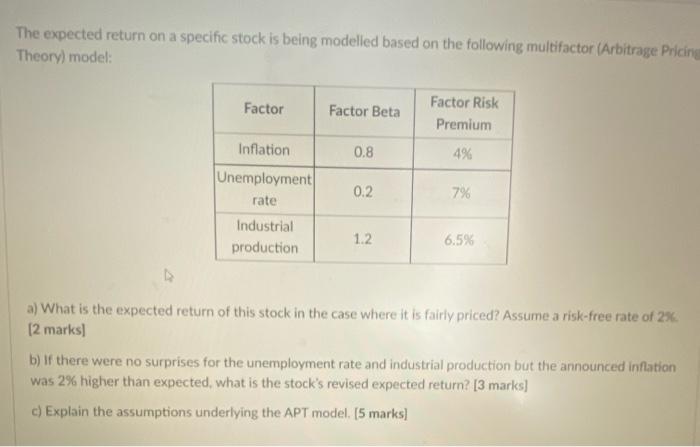

Question: The expected return on a specific stock is being modelled based on the following multifactor (Arbitrage Pricing Theory) model: Factor Factor Beta Factor Risk Premium

The expected return on a specific stock is being modelled based on the following multifactor (Arbitrage Pricing Theory) model: Factor Factor Beta Factor Risk Premium Inflation 0.8 4% 0.2 7% Unemployment rate Industrial production 1.2 6.5% a) What is the expected return of this stock in the case where it is fairly priced? Assume a risk-free rate of 236 [2 marks) b) If there were no surprises for the unemployment rate and industrial production but the announced inflation was 2% higher than expected, what is the stock's revised expected return? [3 marks) c) Explain the assumptions underlying the APT model. (5 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts