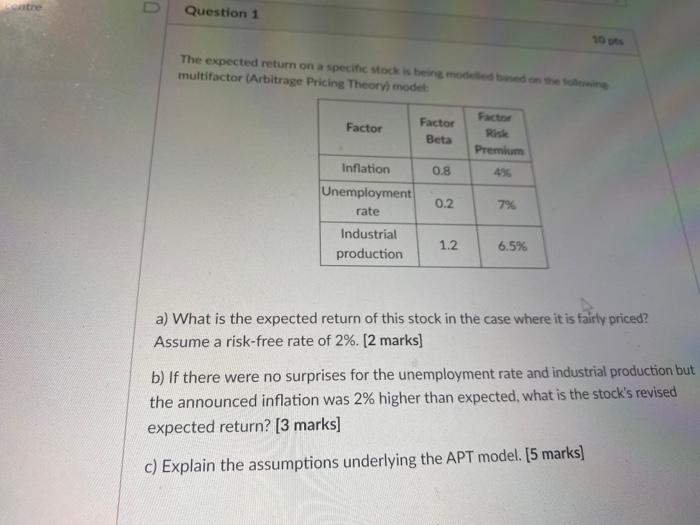

Question: U Question 1 The expected return on a specific stock is being made eden multifactor (Arbitrage Pricing Theory, modet Facto Factor Factor Risk Beta Premium

U Question 1 The expected return on a specific stock is being made eden multifactor (Arbitrage Pricing Theory, modet Facto Factor Factor Risk Beta Premium Inflation 0.8 435 Unemployment 0.2 -7% rate Industrial 1.2 6.5% production a) What is the expected return of this stock in the case where it is fairly priced? Assume a risk-free rate of 2% [2 marks] b) If there were no surprises for the unemployment rate and industrial production but the announced inflation was 2% higher than expected, what is the stock's revised expected return? [3 marks] c) Explain the assumptions underlying the APT model. [5 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts