Question: Given the above stated statements, a number of auditors argued that; 1. The external auditor (the CPA) has to over document their audit process

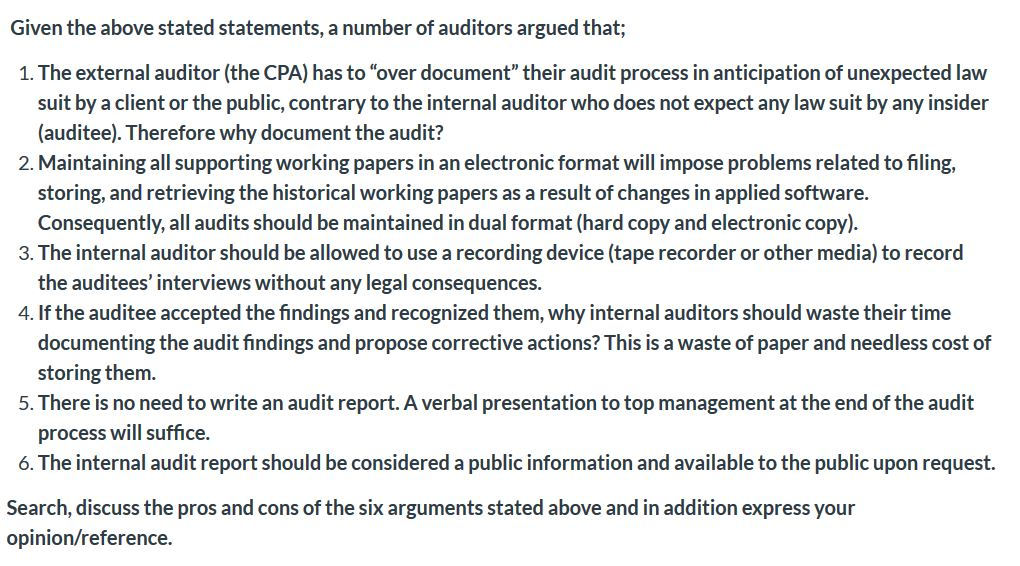

Given the above stated statements, a number of auditors argued that; 1. The external auditor (the CPA) has to "over document" their audit process in anticipation of unexpected law suit by a client or the public, contrary to the internal auditor who does not expect any law suit by any insider (auditee). Therefore why document the audit? 2. Maintaining all supporting working papers in an electronic format will impose problems related to filing, storing, and retrieving the historical working papers as a result of changes in applied software. Consequently, all audits should be maintained in dual format (hard copy and electronic copy). 3. The internal auditor should be allowed to use a recording device (tape recorder or other media) to record the auditees' interviews without any legal consequences. 4. If the auditee accepted the findings and recognized them, why internal auditors should waste their time documenting the audit findings and propose corrective actions? This is a waste of paper and needless cost of storing them. 5. There is no need to write an audit report. A verbal presentation to top management at the end of the audit process will suffice. 6. The internal audit report sh be considered a public information and available to the public upon request. Search, discuss the pros and cons of the six arguments stated above and in addition express your opinion/reference.

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

1 The external auditor CPA has to over document their audit process in anticipation of an unexpected lawsuit by a client or the public contrary to the internal auditor who does not expect any lawsuit ... View full answer

Get step-by-step solutions from verified subject matter experts