Question: The Extra Mile Zig Ziglar was quoted as saying ... There are no traffic jams when you go the extra mile. Break out of the

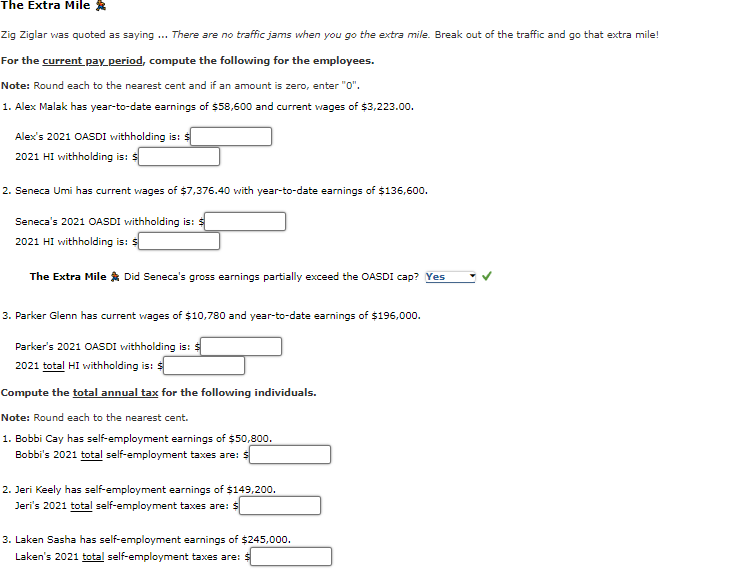

The Extra Mile Zig Ziglar was quoted as saying ... There are no traffic jams when you go the extra mile. Break out of the traffic and go that extra mile! For the current pay_period, compute the following for the employees. Note: Round each to the nearest cent and if an amount is zero, enter "0". 1. Alex Malak has year-to-date earnings of $58,600 and current wages of $3,223.00. Alex's 2021 OASDI withholding is: \$ 2021HI withholding is: 5 2. Seneca Umi has current wages of $7,376.40 with year-to-date earnings of $136,600. Seneca's 2021 OASDI withholding is: 2021 HI withholding is: \& The Extra Mile f. A Did Seneca's gross earnings partially exceed the OASDI cap? 3. Parker Glenn has current wages of $10,780 and year-to-date earnings of $196,000. Parker's 2021 OASDI withholding is: \$ 2021 total HI withholding is: \$\$ Compute the total annual tax for the following individuals. Note: Round each to the nearest cent. 1. Bobbi Cay has self-employment earnings of $50,800. Bobbi's 2021 total self-employment taxes are: s 2. Jeri Keely has self-employment earnings of $149,200. Jeri's 2021 total self-employment taxes are: \$ 3. Laken Sasha has self-employment earnings of $245,000. Laken's 2021 total self-employment taxes are: \& The Extra Mile Zig Ziglar was quoted as saying ... There are no traffic jams when you go the extra mile. Break out of the traffic and go that extra mile! For the current pay_period, compute the following for the employees. Note: Round each to the nearest cent and if an amount is zero, enter "0". 1. Alex Malak has year-to-date earnings of $58,600 and current wages of $3,223.00. Alex's 2021 OASDI withholding is: \$ 2021HI withholding is: 5 2. Seneca Umi has current wages of $7,376.40 with year-to-date earnings of $136,600. Seneca's 2021 OASDI withholding is: 2021 HI withholding is: \& The Extra Mile f. A Did Seneca's gross earnings partially exceed the OASDI cap? 3. Parker Glenn has current wages of $10,780 and year-to-date earnings of $196,000. Parker's 2021 OASDI withholding is: \$ 2021 total HI withholding is: \$\$ Compute the total annual tax for the following individuals. Note: Round each to the nearest cent. 1. Bobbi Cay has self-employment earnings of $50,800. Bobbi's 2021 total self-employment taxes are: s 2. Jeri Keely has self-employment earnings of $149,200. Jeri's 2021 total self-employment taxes are: \$ 3. Laken Sasha has self-employment earnings of $245,000. Laken's 2021 total self-employment taxes are: \&

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts