Question: The final answer net disadvantage is ( $700 ) Giddy-Up Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000

The final answer net disadvantage is ( $700 )

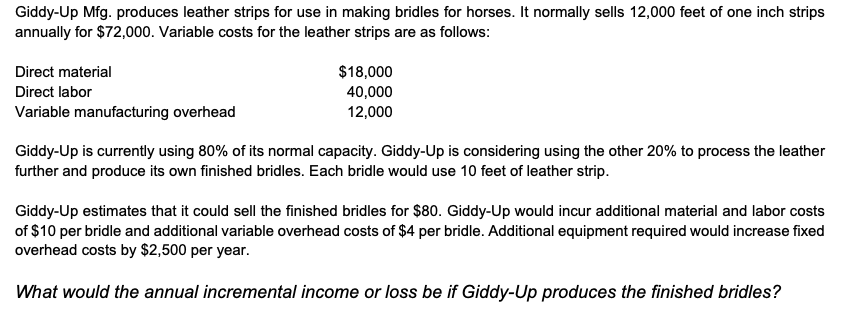

Giddy-Up Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000 feet of one inch strips annually for $72,000. Variable costs for the leather strips are as follows: Direct material Direct labor Variable manufacturing overhead $18,000 40,000 12,000 Giddy-Up is currently using 80% of its normal capacity. Giddy-Up is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Giddy-Up estimates that it could sell the finished bridles for $80. Giddy-Up would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year. What would the annual incremental income or loss be if Giddy-Up produces the finished bridles!? Giddy-Up Mfg. produces leather strips for use in making bridles for horses. It normally sells 12,000 feet of one inch strips annually for $72,000. Variable costs for the leather strips are as follows: Direct material Direct labor Variable manufacturing overhead $18,000 40,000 12,000 Giddy-Up is currently using 80% of its normal capacity. Giddy-Up is considering using the other 20% to process the leather further and produce its own finished bridles. Each bridle would use 10 feet of leather strip. Giddy-Up estimates that it could sell the finished bridles for $80. Giddy-Up would incur additional material and labor costs of $10 per bridle and additional variable overhead costs of $4 per bridle. Additional equipment required would increase fixed overhead costs by $2,500 per year. What would the annual incremental income or loss be if Giddy-Up produces the finished bridles

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts