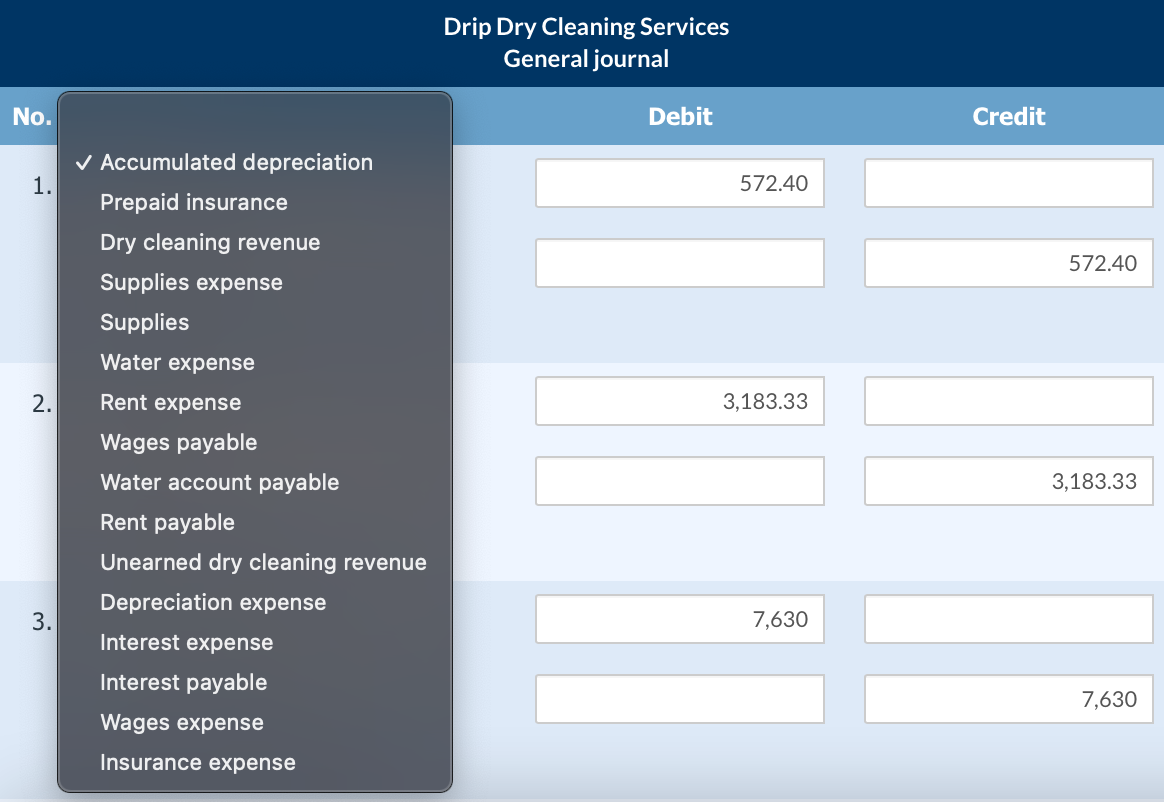

Question: The financial year for Drip Dry Cleaning Services ends on 30 June. Using the following information, make the necessary adjusting entries at year-end. Ignore GST.

The financial year for Drip Dry Cleaning Services ends on 30 June. Using the following information, make the necessary adjusting entries at year-end. Ignore GST. (Enter debit entries first, followed by credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. Round answers to 0 decimal places, e.g. 1,525.)

| 1. | On 15 February, Danielle Drip's business borrowed $16,960 from Northern Bank at 9% interest. The principal and interest are payable on 15 August. | |

| 2. | Rent of $3,820 for the 6-month period ending 31 July is due to be paid in August. | |

| 3. | The annual depreciation on equipment is estimated to be $7,630. The 1 July balance in the Accumulated Depreciation account was $16,540. | |

| 4. | Drip Dry Cleaning Services purchased a 1-year insurance policy on 1 March of the current year for $700. A 3-year policy was purchased on 1 November of the previous year for $2,860. Both purchases were recorded by debiting Prepaid Insurance. | |

| 5. | The business has 2 part-time employees who each earn $230 a day. They both worked the last 3 days in June for which they have not yet been paid. | |

| 6. | On 1 June, the Highup Hotel paid the business $2,230 in advance for doing their dry cleaning for the next 3 months. This was recorded by a credit to Unearned Dry Cleaning Revenue. | |

| 7. | Water for June of $900 is unpaid and unrecorded. | |

| 8. | The supplies account had a $300 debit balance on 1 July. Supplies of $1,650 were purchase during the year and $200 of supplies are on hand as at 30 June. |

Drip Dry Cleaning Services General journal No. Debit Credit 1. 572.40 Accumulated depreciation Prepaid insurance Dry cleaning revenue Supplies expense Supplies 572.40 Water expense 2. Rent expense 3,183.33 3,183.33 Wages payable Water account payable Rent payable Unearned dry cleaning revenue Depreciation expense Interest expense Interest payable Wages expense Insurance expense 3. 7,630 7,630

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts