Question: An associate is running a business (coffee and soup shop) and presents do you to financial statements for the company below. They are very excited

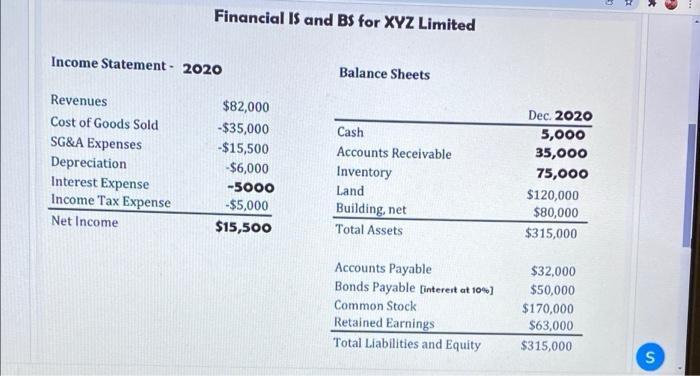

An associate is running a business (coffee and soup shop) and presents do you to financial statements for the company below.

They are very excited about expanding (to another location) and would like to borrow some more money from you so that they can expand their bussines

Have a look at their income statement and balance sheet, and ask one or two questions to your associate that you would like to find out before deciding if you will give them a loan

Income Statement - 2020 Revenues Cost of Goods Sold SG&A Expenses Financial IS and BS for XYZ Limited Depreciation Interest Expense Income Tax Expense Net Income $82,000 -$35,000 -$15,500 -$6,000 -5000 -$5,000 $15,500 Balance Sheets Cash Accounts Receivable Inventory Land Building, net Total Assets Accounts Payable Bonds Payable [interest at 10% ] Common Stock Retained Earnings Total Liabilities and Equity Dec. 2020 5,000 35,000 75,000 $120,000 $80,000 $315,000 $32,000 $50,000 $170,000 $63,000 $315,000 2 S

Step by Step Solution

3.47 Rating (163 Votes )

There are 3 Steps involved in it

Ratio Analysis Profitability ratio operating profit ratio operating profitsales 2550082000 3110 oper... View full answer

Get step-by-step solutions from verified subject matter experts