Question: the first guy that i asked here got it wrong lol. pls help Attempts 2 10. Problem 7.05 (Bond Valuation) eBook Problem Walk Through An

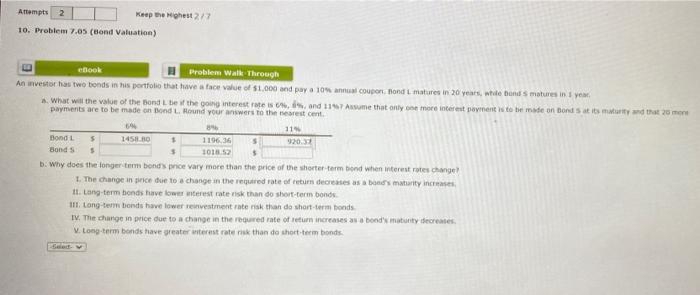

Attempts 2 10. Problem 7.05 (Bond Valuation) eBook Problem Walk Through An investor has two bonds in his portfolio that have a face value of $1.000 and pay a 10% annual coupon, Bond L matures in 20 years, while bond s matures in 1 year. Keep the Highest 2/7 a. What will the value of the Bond L be if the going interest rate is 6%, 8%, and 11%7 Assume that only one more interest payment is to be made on Bonds at its maturity and that 20 mone payments are to be made on Bond L. Round your answers to the nearest cent. 11% 920.32 Bond L Bond S $ S 1458.80 $ $ 1196.36 S 1018.52 b. Why does the longer-term bond's price vary more than the price of the shorter-term bond when interest rates change? 1. The change in pirice due to a change in the required rate of return decreases as a bond's maturity increases 11. Long-term bonds have lower interest rate risk than do short-term bonds. 111. Long-term bonds have lower reinvestment rate risk than do short-term bonds IV. The change in price due to a change in the required rate of return increases as a bond's maturity decreases. V. Long-term bonds have greater interest rate risk than do short-term bonds

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts