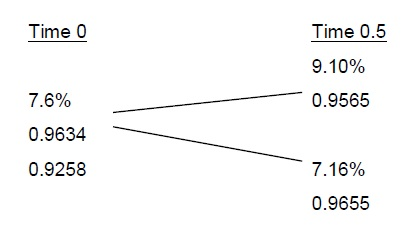

Question: The first number at each node in the tree below is the 0.5-year rate at that node. The second number at each node is the

The first number at each node in the tree below is the 0.5-year rate at that node. The second number at each node is the price of $1 par of a 0.5-year zero at that node. The third number (if it appears) is the price of $1 par of a 1-year zero at that node.

a) (i) Determine the tree of ex-coupon prices for $100 par of a 1-year 8% semi-annual coupon noncallable bond. The tree should go out to time 0.5.

ii) What are the SR $duration and SR duration of this bond?

b) Consider an American call option on the coupon bond in part (a). The strike price of the option is 100. The option can be exercised either at time 0 or at time 0.5. What is the value of this option at time 0?

c) A firm has issued an 8% coupon bond that matures at time 1. The bond is callable at par on any coupon date. The firm follows a call policy that minimizes the value of its debt. Should the firm call the bond at time 0?

d) Parties A and B have entered into a plain vanilla semi-annual interest rate swap in which B pays A a fixed rate of 8% and A pays B a floating rate equal to the 6-month rate observed 6-months prior to the payment date. The notional amount of the swap is $100 and the swap matures at time 1. (i) Suppose the swap is not cancelable. What is the value of As position at time 0? (ii) Suppose B has the right to cancel the swap at no cost on any payment date, ex-payment (i.e., after the currently scheduled payment has been exchanged). What is the value of As total position at time 0? (iii) Suppose instead that A has the right to cancel the swap on any payment date, ex-payment. What is the total value of As position at time 0?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts