Question: The first photo is the problem. The second and third are the answers. Can you please thoroughly explain how to get each of the numbers

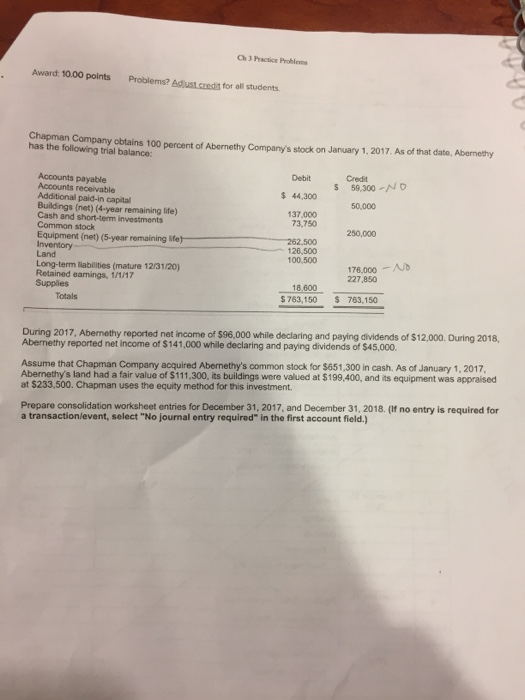

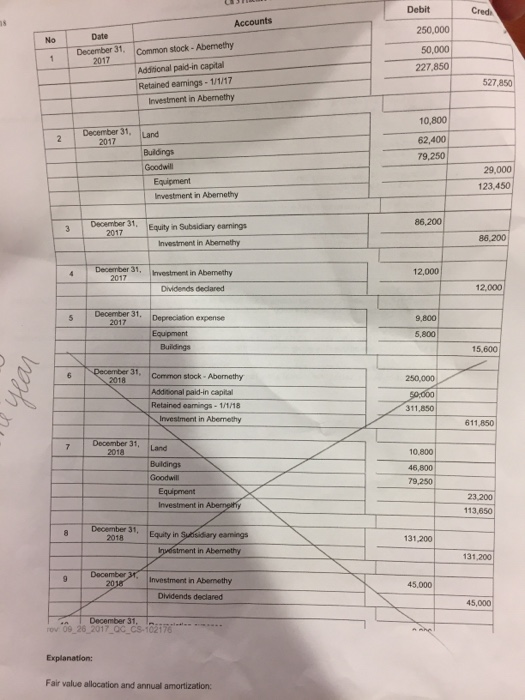

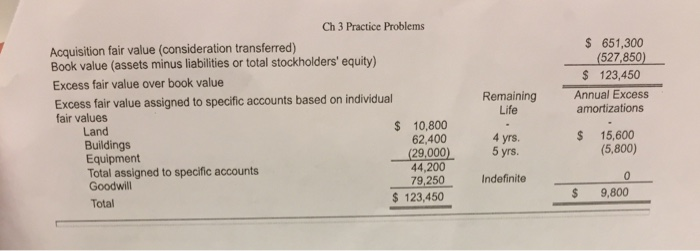

Ch 3 Practice Problems Award: 10.00 points Problems? diust.ccedit for all students. Chapman Company obtains 100 percent of Abernethy Company's stock on January 1, 2017. As of that dato, Abernethy has the following trial balance: Debit s 44,300 Credit S 59,300-NO Accounts payable Accounts receivable Additional paid-in capital Buildings (net) (4-year remaining life) Cash and short-term investments Common stock 50,000 137,000 73,750 250,000 262,500 126,500 100,500 Equipment (net) (5-year remaining life) Land Long-term labilities (mature 12/31/20) Retained eanings, 1/1/17 Supplies 176,000A 227,850 18.600 $763,150 763.150 Totals During 2017, Abermethy reported net income of $96,000 while declaring and paying dividends of $12,000. During 2018, Abernethy reported net income of $141,000 while declaring and paying dividends of $45,000. Assume that Chapman Company acquired Abernethy's common stock for $651,300 in cash. As of January 1, 2017, Abemethy's land had a fair value of $111,300, its buildings were valued at $199,400, and its equipment was appraised at $233,500. Chapman uses the equity method for this investment Prepare consolidation worksheet entries for December 31, 2017, and December 31, 2018. (If no entry is required for a transactionlevent, select "No journal entry required" in the first account field.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts