Question: the first pic is the question and the second pic is my answer. i tried but its incomplete idk where did i go wrong. pls

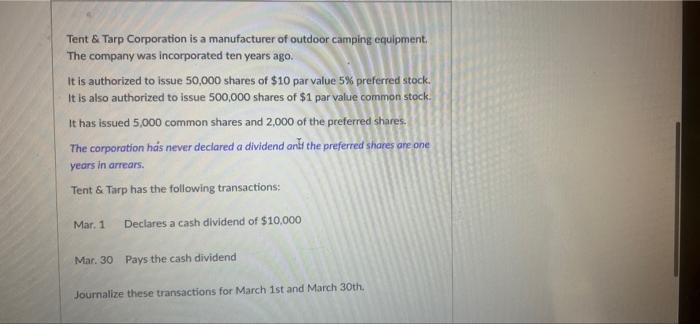

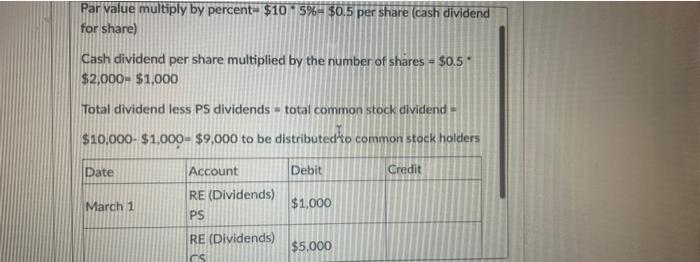

Tent & Tarp Corporation is a manufacturer of outdoor camping equipment The company was incorporated ten years ago. It is authorized to issue 50,000 shares of $10 par value 5% preferred stock. It is also authorized to issue 500,000 shares of $1 par value common stock It has issued 5,000 common shares and 2,000 of the preferred shares. The corporation has never declared a dividend all the preferred shares are one years in arrears. Tent & Tarp has the following transactions: Mar. 1 Declares a cash dividend of $10,000 Mar. 30 Pays the cash dividend Journalize these transactions for March 1st and March 30th Par value multiply by percent: $105%- $0.5 per share (cash dividend for share) Cash dividend per share multiplied by the number of shares = $0.51 $2,000-$1,000 Total dividend less PS dividends - total common stock dividend $10,000-$1,000 - $9,000 to be distributed to common stock holders Date Debit Credit Account RE (Dividends) PS March 1 $1,000 RE (Dividends) GS $5,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts