Question: the first picture is the problem i need help with. the second picture is an example on how to do it. eBook The real risk-free

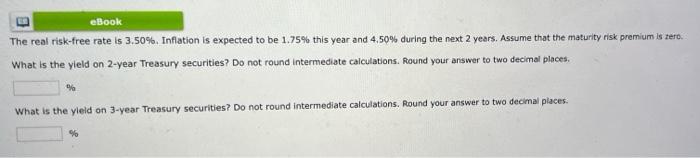

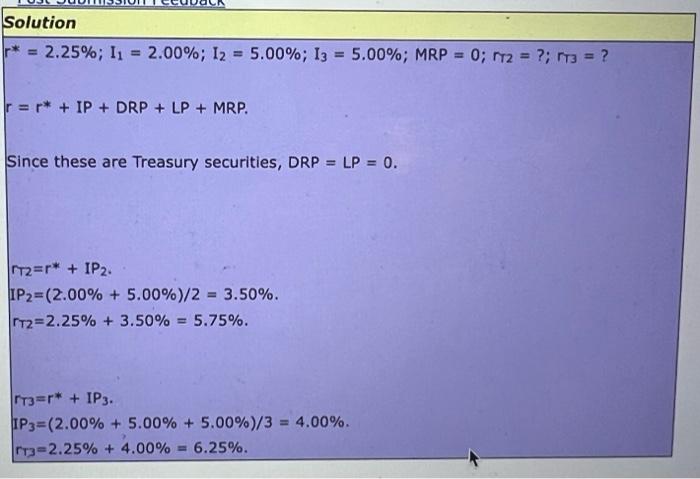

eBook The real risk-free rate is 3.50%. Inflation is expected to be 1.75% this year and 4,50 % during the next 2 years. Assume that the maturity risk premium is zero. What is the yield on 2-year Treasury securities? Do not round intermediate calculations. Round your answer to two decimal places. % What is the yield on 3-year Treasury securities? Do not round intermediate calculations. Round your answer to two decimal places. % Solution = 2.25%; I1 = 2.00%; 12 = 5.00%; 13 = 5.00%; MRP = 0; T2 = ?; FT3 = ? r = r* + IP + DRP + LP + MRP. Since these are Treasury securities, DRP = LP = 0. T2=r* + IP. IP2=(2.00% + 5.00%)/2= 3.50%. T2=2.25% + 3.50% = 5.75%. T3=r* + IP3. IP3 (2.00% + 5.00% + 5.00%)/3 = 4.00%. rr3-2.25% + 4.00%= 6.25%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts