Question: the first picture is the problem i need help with. the second picture is an example on how to do it. eBook A Treasury bond

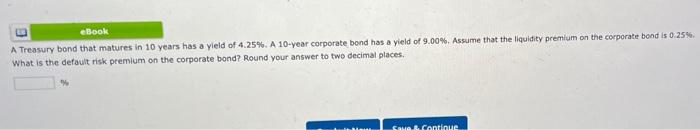

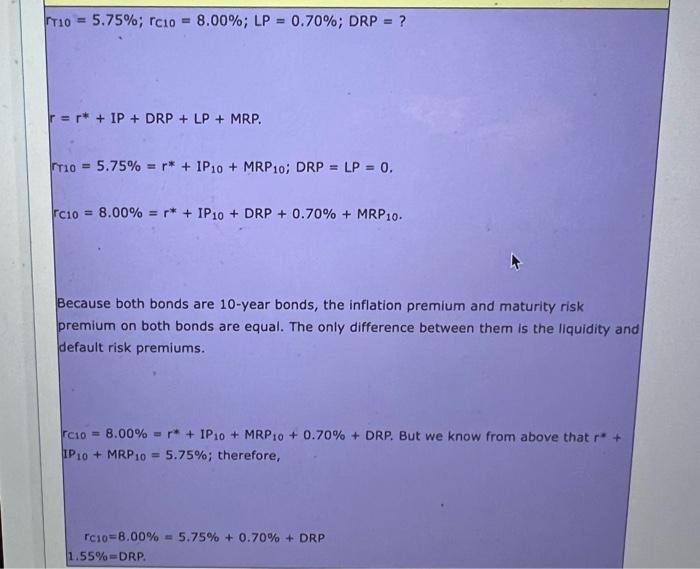

eBook A Treasury bond that matures in 10 years has a yield of 4.25%. A 10-year corporate bond has a yield of 9.00%. Assume that the liquidity premium on the corporate bond is 0.25%. What is the default risk premium on the corporate bond? Round your answer to two decimal places.. % Save & Continue T10 = 5.75%; rc10 = 8.00%; LP = 0.70%; DRP = ? r = r* + IP + DRP + LP + MRP. T10 = 5.75% = r* + 1P10 + MRP10; DRP = LP = 0. FC10 = 8.00% = r* + IP10 + DRP + 0.70% + MRP 10. Because both bonds are 10-year bonds, the inflation premium and maturity risk premium on both bonds are equal. The only difference between them is the liquidity and default risk premiums. C10 = 8.00% + IP10 + MRP10 + 0.70% + DRP. But we know from above that r* + IP10+ MRP10 = 5.75%; therefore, rc10=8.00% = 5.75% +0.70% + DRP 1.55% DRP

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts