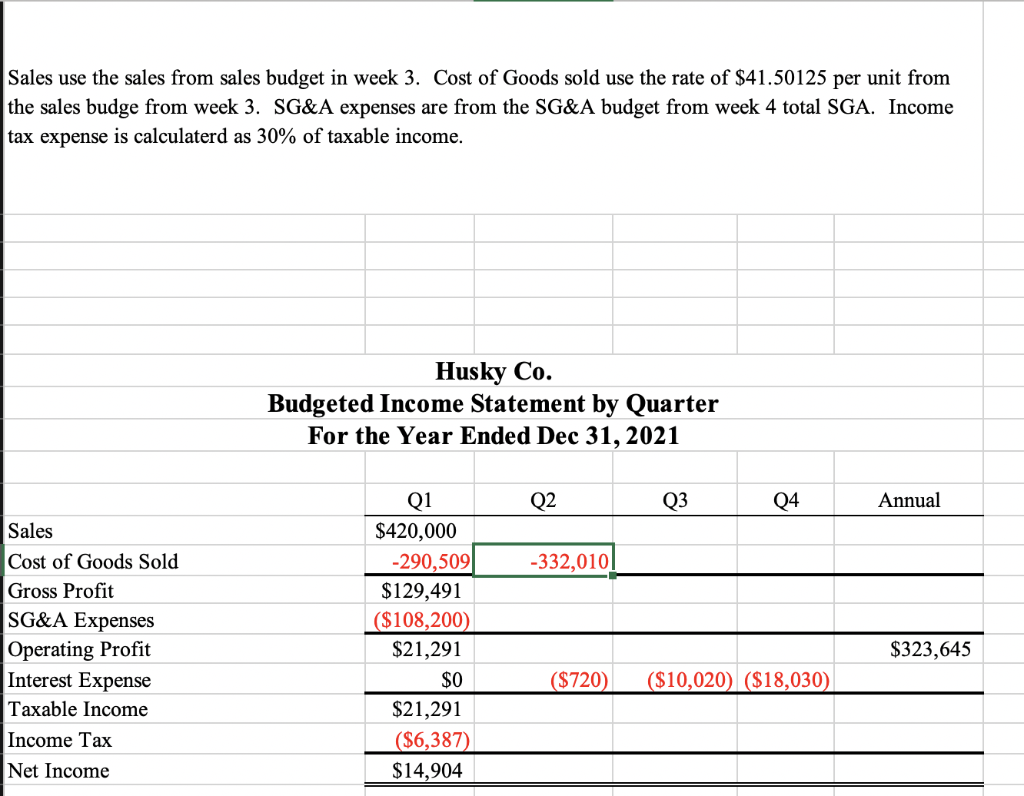

Question: The first picture is the question below. Reading it explains the next few sentences. It shows to use the sales from the sales budget in

- The first picture is the question below. Reading it explains the next few sentences.

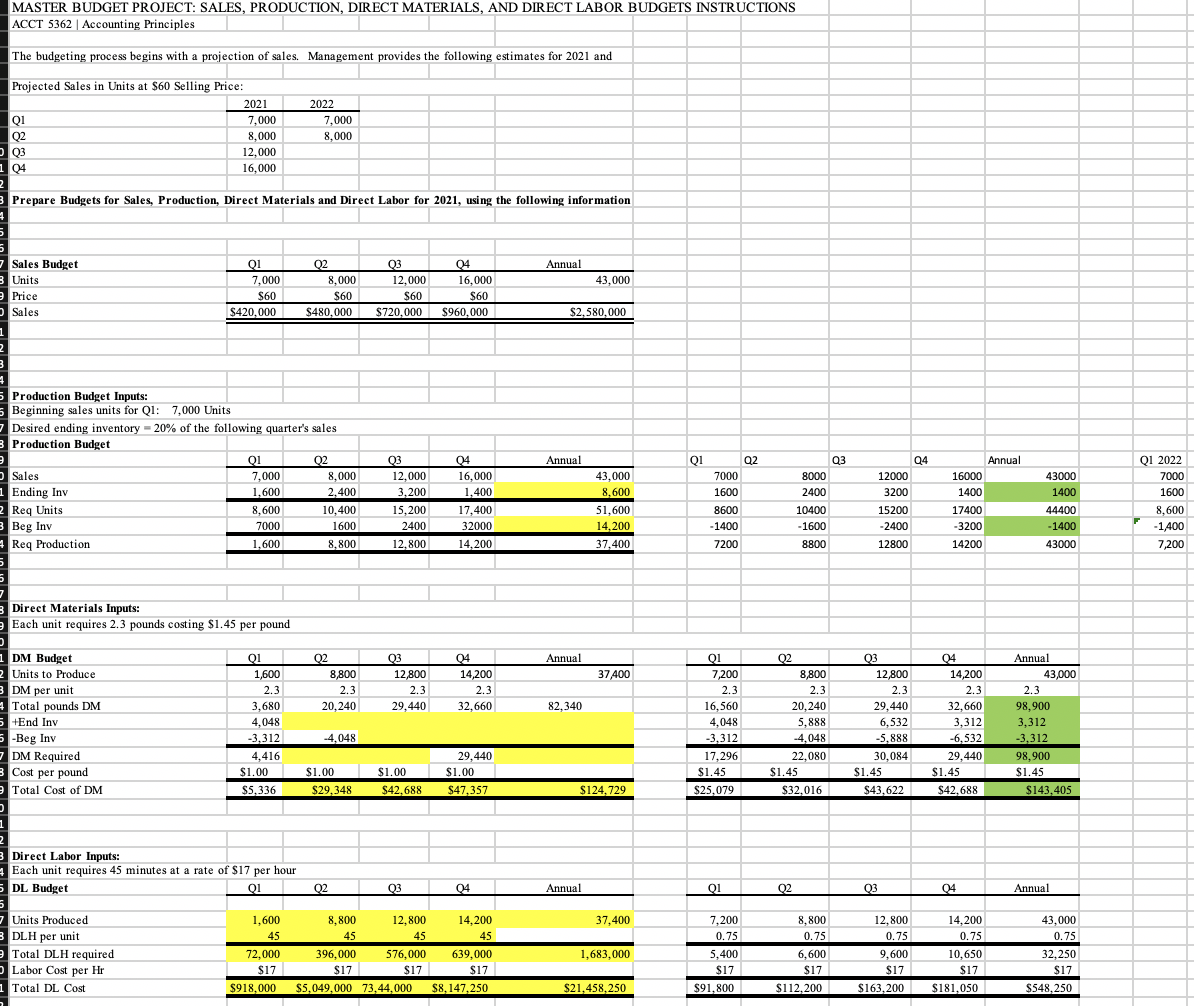

- It shows to use the sales from the sales budget in week 3. This is the past solution from that week is in the second picture below. (There were some corrections, correct answers on the right also where you see green).

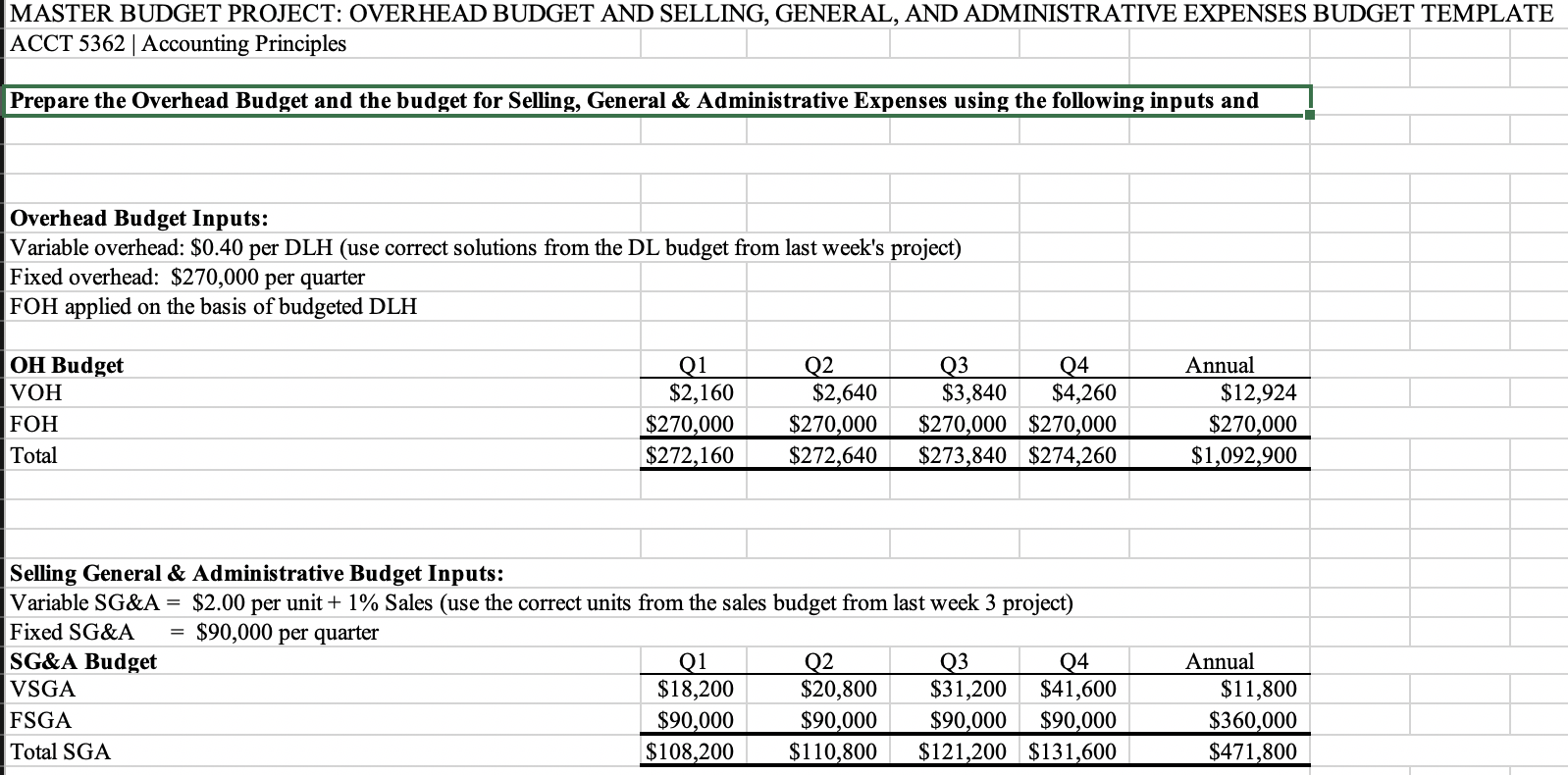

- SG&A expenses are from the SG&A budget from week 4 total SGA is the third picture below

Question:

Week 3

Week 4

Sales use the sales from sales budget in week 3. Cost of Goods sold use the rate of $41.50125 per unit from the sales budge from week 3. SG\&A expenses are from the SG\&A budget from week 4 total SGA. Income tax expense is calculaterd as 30% of taxable income. MASTER BUDGET PROJECT: SALES, PRODUCTION, DIRECT MATERIALS, AND DIRECT LABOR BUDGETS INSTRUCTIONS ACCT 5362 Accounting Principles The budgeting process begins with a projection of sales. Management provides the following estimates for 2021 and Projected Sales in Units at $60 Selling Price: Prepare Budgets for Sales, Production, Direct Materials and Direct Labor for 2021, using the following information \begin{tabular}{l} 5 Production Budget Inputs: \\ Beginning sales units for Q1: 7,000 Units \\ \hline \end{tabular} Desired ending inventory =20% of the following quarter's sales MASTER BUDGET PROJECT: OVERHEAD BUDGET AND SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES BUDGET TEMPLATE ACCT 5362 | Accounting Principles Prepare the Overhead Budget and the budget for Selling, General \& Administrative Expenses using the following inputs and Overhead Budget Inputs: Variable overhead: $0.40 per DLH (use correct solutions from the DL budget from last week's project) Fixed overhead: $270,000 per quarter FOH applied on the basis of budgeted DLH \begin{tabular}{|lrrrrrr} \hline OH Budget & \multicolumn{1}{c}{ Q1 } & \multicolumn{1}{c}{ Q2 } & \multicolumn{1}{c}{ Q3 } & \multicolumn{1}{c}{ Q4 } & \multicolumn{1}{c}{ Annual } \\ \hline VOH & $2,160 & $2,640 & $3,840 & $4,260 & $12,924 \\ FOH & $270,000 & $270,000 & $270,000 & $270,000 & $270,000 \\ \hline Total & $272,160 & $272,640 & $273,840 & $274,260 & $1,092,900 \\ \hline \end{tabular} Selling General \& Administrative Budget Inputs: Variable SG\&A =$2.00 per unit +1% Sales (use the correct units from the sales budget from last week 3 project) Fixed SG\&A =$90,000 per quarter SG\&A Budget Sales use the sales from sales budget in week 3. Cost of Goods sold use the rate of $41.50125 per unit from the sales budge from week 3. SG\&A expenses are from the SG\&A budget from week 4 total SGA. Income tax expense is calculaterd as 30% of taxable income. MASTER BUDGET PROJECT: SALES, PRODUCTION, DIRECT MATERIALS, AND DIRECT LABOR BUDGETS INSTRUCTIONS ACCT 5362 Accounting Principles The budgeting process begins with a projection of sales. Management provides the following estimates for 2021 and Projected Sales in Units at $60 Selling Price: Prepare Budgets for Sales, Production, Direct Materials and Direct Labor for 2021, using the following information \begin{tabular}{l} 5 Production Budget Inputs: \\ Beginning sales units for Q1: 7,000 Units \\ \hline \end{tabular} Desired ending inventory =20% of the following quarter's sales MASTER BUDGET PROJECT: OVERHEAD BUDGET AND SELLING, GENERAL, AND ADMINISTRATIVE EXPENSES BUDGET TEMPLATE ACCT 5362 | Accounting Principles Prepare the Overhead Budget and the budget for Selling, General \& Administrative Expenses using the following inputs and Overhead Budget Inputs: Variable overhead: $0.40 per DLH (use correct solutions from the DL budget from last week's project) Fixed overhead: $270,000 per quarter FOH applied on the basis of budgeted DLH \begin{tabular}{|lrrrrrr} \hline OH Budget & \multicolumn{1}{c}{ Q1 } & \multicolumn{1}{c}{ Q2 } & \multicolumn{1}{c}{ Q3 } & \multicolumn{1}{c}{ Q4 } & \multicolumn{1}{c}{ Annual } \\ \hline VOH & $2,160 & $2,640 & $3,840 & $4,260 & $12,924 \\ FOH & $270,000 & $270,000 & $270,000 & $270,000 & $270,000 \\ \hline Total & $272,160 & $272,640 & $273,840 & $274,260 & $1,092,900 \\ \hline \end{tabular} Selling General \& Administrative Budget Inputs: Variable SG\&A =$2.00 per unit +1% Sales (use the correct units from the sales budget from last week 3 project) Fixed SG\&A =$90,000 per quarter SG\&A Budget

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts