Question: The first question continued to the second question That was solved in the previous first question Q. 02: Refer to the previous problem. Assume that

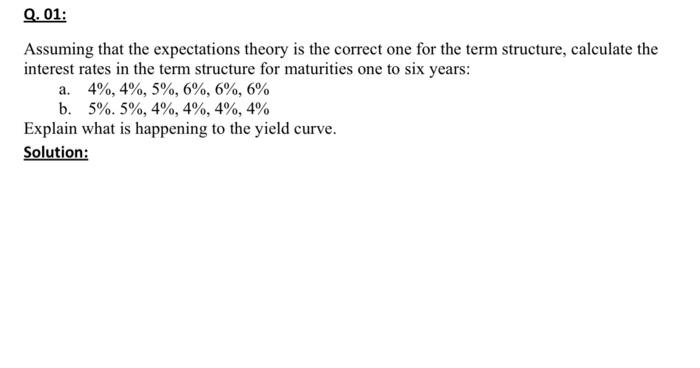

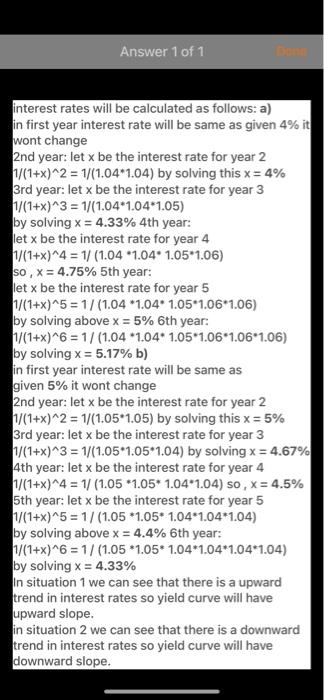

Q. 02: Refer to the previous problem. Assume that instead of the expectations theory, the liquidity premium theory takes place. What will be your answer to parts a and b, if the following liquidity premiums are expected? 0%; 0.25%, 0.5%, 0.75%, 1%, and 1.25% respectively? Solution: Q. 01: Assuming that the expectations theory is the correct one for the term structure, calculate the interest rates in the term structure for maturities one to six years: a. 4%, 4%, 5%, 6%, 6%, 6% b. 5%. 5%, 4%, 4%, 4%, 4% Explain what is happening to the yield curve. Solution: Answer 1 of 1 interest rates will be calculated as follows: a) in first year interest rate will be same as given 4% it wont change 2nd year: let x be the interest rate for year 2 V/(1+x)^2 = 1/(1.04*1.04) by solving this x = 4% 3rd year: let x be the interest rate for year 3 V/(1+x)^3 = 1/(1.04*1.04*1.05) by solving x = 4.33% 4th year: let x be the interest rate for year 4 1/(1+x)^4 = 1/(1.04 *1.04.1.05*1.06) so, x = 4.75% 5th year: let x be the interest rate for year 5 V/(1+x)^5 = 1/(1.04*1.04 1.05*1.06*1.06) by solving above x = 5% 6th year: V(1+x)^6 = 1/(1.04 *1.04 1.05*1.061.06*1.06) by solving x = 5.17% b) in first year interest rate will be same as given 5% it wont change 2nd year: let x be the interest rate for year 2 V/(1+x)^2 = 1/(1.05-1.05) by solving this x = 5% 3rd year: let x be the interest rate for year 3 V/(1+x)^3 = 1/(1.05*1.051.04) by solving x = 4.67% 4th year: let x be the interest rate for year 4 1/(1+x)^4 = 1/(1.05*1.05* 1.041.04) so, x = 4.5% 5th year: let x be the interest rate for year 5 V(1+x)^5 = 1/(1.05 *1.05* 1.04*1.04*1.04) by solving above x = 4.4% 6th year: V/(1+x)*6 = 1/(1.05*1.051.04*1.04*1.04*1.04) by solving x = 4.33% In situation 1 we can see that there is a upward trend in interest rates so yield curve will have upward slope. in situation 2 we can see that there is a downward trend in interest rates so yield curve will have downward slope. 7:04 ) A-03-Ch 05 FINA 215/MBA 666 - Financial Markets & Institutions Activity 03 (Chapter 05) NAME ID 2.01 Assuming that the expectations theory is the correct one for the term structure, calculate the interest rates in the term structure for maturities one to six years 44% 4% 5% 6%, 0%, 0% b. 55% 44% 4% 496 Explain what is happening to the yield curve. Solution: 0.02 Refer to the previous problem. Assume that instead of the expectations theory, the liquidity premium theory takes place. What will be your answer to parts and birde Sollowing liquidity premiums are expected? 0% 0.25% 0.5%, 0.75%, 1%, and 1.2% respectively Solution: Q. 02: Refer to the previous problem. Assume that instead of the expectations theory, the liquidity premium theory takes place. What will be your answer to parts a and b, if the following liquidity premiums are expected? 0%; 0.25%, 0.5%, 0.75%, 1%, and 1.25% respectively? Solution: Q. 01: Assuming that the expectations theory is the correct one for the term structure, calculate the interest rates in the term structure for maturities one to six years: a. 4%, 4%, 5%, 6%, 6%, 6% b. 5%. 5%, 4%, 4%, 4%, 4% Explain what is happening to the yield curve. Solution: Answer 1 of 1 interest rates will be calculated as follows: a) in first year interest rate will be same as given 4% it wont change 2nd year: let x be the interest rate for year 2 V/(1+x)^2 = 1/(1.04*1.04) by solving this x = 4% 3rd year: let x be the interest rate for year 3 V/(1+x)^3 = 1/(1.04*1.04*1.05) by solving x = 4.33% 4th year: let x be the interest rate for year 4 1/(1+x)^4 = 1/(1.04 *1.04.1.05*1.06) so, x = 4.75% 5th year: let x be the interest rate for year 5 V/(1+x)^5 = 1/(1.04*1.04 1.05*1.06*1.06) by solving above x = 5% 6th year: V(1+x)^6 = 1/(1.04 *1.04 1.05*1.061.06*1.06) by solving x = 5.17% b) in first year interest rate will be same as given 5% it wont change 2nd year: let x be the interest rate for year 2 V/(1+x)^2 = 1/(1.05-1.05) by solving this x = 5% 3rd year: let x be the interest rate for year 3 V/(1+x)^3 = 1/(1.05*1.051.04) by solving x = 4.67% 4th year: let x be the interest rate for year 4 1/(1+x)^4 = 1/(1.05*1.05* 1.041.04) so, x = 4.5% 5th year: let x be the interest rate for year 5 V(1+x)^5 = 1/(1.05 *1.05* 1.04*1.04*1.04) by solving above x = 4.4% 6th year: V/(1+x)*6 = 1/(1.05*1.051.04*1.04*1.04*1.04) by solving x = 4.33% In situation 1 we can see that there is a upward trend in interest rates so yield curve will have upward slope. in situation 2 we can see that there is a downward trend in interest rates so yield curve will have downward slope. 7:04 ) A-03-Ch 05 FINA 215/MBA 666 - Financial Markets & Institutions Activity 03 (Chapter 05) NAME ID 2.01 Assuming that the expectations theory is the correct one for the term structure, calculate the interest rates in the term structure for maturities one to six years 44% 4% 5% 6%, 0%, 0% b. 55% 44% 4% 496 Explain what is happening to the yield curve. Solution: 0.02 Refer to the previous problem. Assume that instead of the expectations theory, the liquidity premium theory takes place. What will be your answer to parts and birde Sollowing liquidity premiums are expected? 0% 0.25% 0.5%, 0.75%, 1%, and 1.2% respectively Solution

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts