Question: The first step in the capital budgeting evaluation process is to A) screen proposals by a capital budgeting committee. B) request proposals for projects. C)

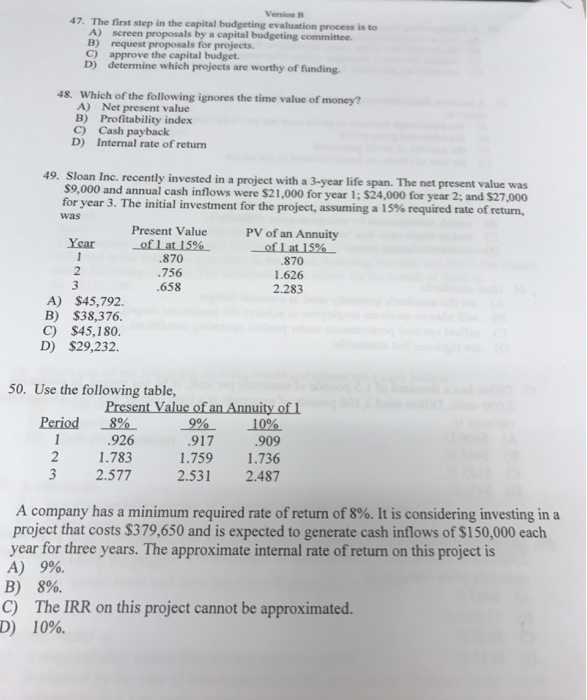

The first step in the capital budgeting evaluation process is to A) screen proposals by a capital budgeting committee. B) request proposals for projects. C) approve the capital budget. D) determine which projects are worthy of funding. Which of the following ignores the time value of money? A) Net present value B) Profitability index C) Cash payback D) Internal rate of return Sloan Inc. recently invested in a project with a 3-year life span. The net present value was $9,000 and annual cash inflows we $21,000 for year 1; $24,000 for year 2; and $27,000 for year 3. The initial investment for the project, assuming a 15% required rate of return, was A) $45, 792. B) $38, 376. C) $45, 180. D) $29, 232. Use the following table, A company has a minimum required rate of return of 8%. It is considering investing in a project that costs $379, 650 and is expected to generate cash inflows of $150,000 each year for three years. The approximate internal rate of return on this project is A) 9%. B) 8%. C) The IRR on this project cannot be approximated. D) 10%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts