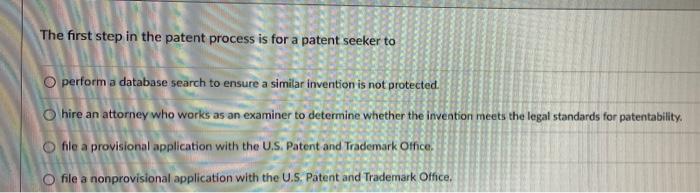

Question: The first step in the patent process is for a patent seeker to O perform a database search to ensure a similar invention is not

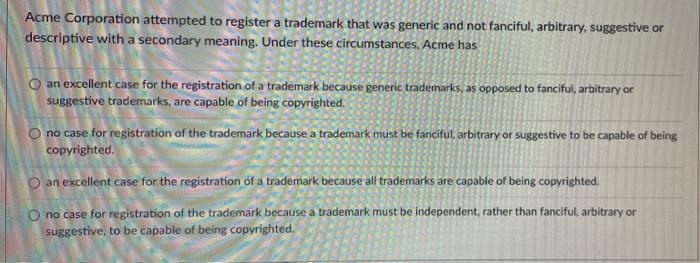

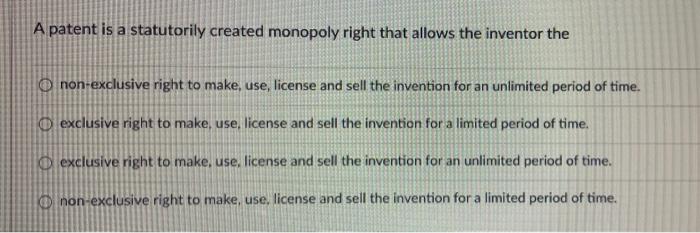

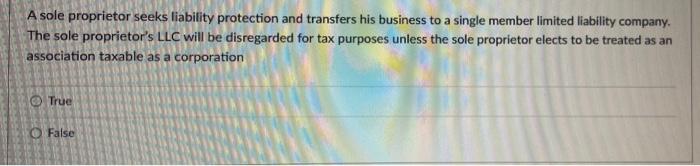

The first step in the patent process is for a patent seeker to O perform a database search to ensure a similar invention is not protected Ohire an attorney who works as an examiner to determine whether the invention meets the legal standards for patentability, hle a provisional application with the U.S. Patent and Trademark Othce. file a nonprovisional application with the U.S. Patent and Trademark Office. Acme Corporation attempted to register a trademark that was generic and not fanciful, arbitrary, suggestive or descriptive with a secondary meaning. Under these circumstances, Acme has O an excellent case for the registration of a trademark because generic trademarks, as opposed to fanciful, arbitrary or suggestive trademarks, are capable of being copyrighted. no case for registration of the trademark because a trademark must be fanciful, arbitrary or suggestive to be capable of being copyrighted. an excellent case for the registration of a trademark because all trademarks are capable of being copyrighted O no case for registration of the trademark because a trademark must be independent, rather than fanciful, arbitrary or suggestive, to be capable of being copyrighted. A patent is a statutorily created monopoly right that allows the inventor the o non-exclusive right to make, use, license and sell the invention for an unlimited period of time. exclusive right to make, use, license and sell the invention for a limited period of time. exclusive right to make, use, license and sell the invention for an unlimited period of time. non-exclusive right to make, use, license and sell the invention for a limited period of time, A sole proprietor seeks liability protection and transfers his business to a single member limited liability company. The sole proprietor's LLC will be disregarded for tax purposes unless the sole proprietor elects to be treated as an association taxable as a corporation True False