Question: The following additional information is available: 1- During the year, a customer purchased three ice cream making machines (A, B & C) from the company.

The following additional information is available:

1- During the year, a customer purchased three ice cream making machines (A, B & C) from the company. The company normally charges for each machine separately a price of £110,000 (A), £140,000 (B) and £150,000 (C). On this sale, the company charged the customer a total price of £300,000, which was paid on 15 June 2021. Machines A & C were delivered to the customer during the year, while B was delivered after the end of the year. None of the accounting entries relating to this transaction have bee recorded and are not reflected in the trial balance.

2- Freehold premises acquired for £1.8 million were revalued in 2018, recognising a gain of £600,000. These include a warehouse, which has a book value of £120,000, was revalued at £150,000 and was sold in June 2021 for £225,000.

3- Brighton wishes to report plant and machinery at open market value which is estimated to be £1,960,000 on 1 July 2020.

4- Company policy is to depreciate its assets on the straight-line method at annual rates as follows: Plant and machinery 10% Furniture and fittings 5%

5- Until this year the company’s policy has been to capitalise development costs, to the extent permitted by relevant accounting standards. The company must now write off the development costs as the project no longer meets the capitalisation criteria.

6- Income tax for the year is estimated at £122,000.

7- Directors propose a final dividend of 4p per share, declared an obligation, but not paid at the year-end.

Required:

(a) Prepare the statement of comprehensive income for the year ended 30 June 2021. (10 marks)

(b) Prepare the statement of financial position as at 30 June 2021.

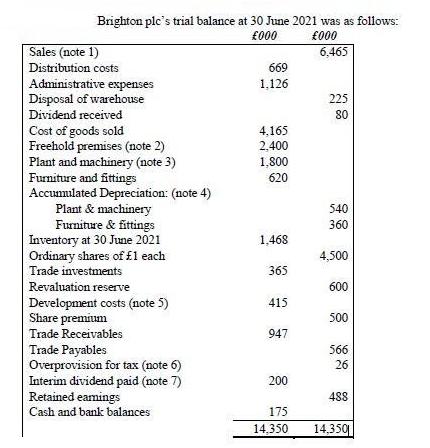

Brighton plc's trial balance at 30 June 2021 was as follows: 000 000 Sales (note 1) 6.465 Distribution costs Administrative expenses Disposal of warehouse 669 1,126 225 Dividend received 80 Cost of goods sold Freehold premises (note 2) Plant and machinery (note 3) Furniture and fittings Accumulated Depreciation: (note 4) Plant & machinery Furniture & fittings Inventory at 30 June 2021 Ordinary shares of l each Trade investments 4,165 2,400 1,800 620 540 360 1,468 4,500 365 Revaluation reserve 600 415 Development costs (note 5) Share premium Trade Receivables 500 947 Trade Payables Overprovision for tax (note 6) Interim dividend paid (note 7) Retained eamings Cash and bank balances 566 26 200 488 175 14,350 14,350

Step by Step Solution

3.44 Rating (147 Votes )

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts